Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

location: Home > News > market analysis

market analysis

market analysis2025-10-23

The bottom finishing prototype is still under construction, 4160-4030 is running

Zheng‘s Point Silver: The prototype of the bottom consolidation is still under construction. 4160-4030 operation review yesterday‘s market trends and emerging technical points: First, gold: Yesterday morning‘s rapid continued decline released overnight short p...

market analysis2025-10-23

Germany's financial abyss, analysis of short-term trends of spot gold, silver, c

Global Market Overview 1. European and American market conditions The three major U.S. stock index futures all fell, with the Dow futures falling 0.20%, the S&P 500 futures falling 0.11%, and the Nasdaq futures falling 0.21%. Germany‘s DAX index fell 0.15%, Br...

market analysis2025-10-23

Trump sanctions Rosneft, WTI stands at $60 mark

XM Review: Trump sanctions Rosneft, WTI stands above the $60 mark XM Review: US President Trump announced sanctions on two major Russian oil companies, Rosneft and Lukoil. Rosneft‘s daily crude oil production is more than 3 million barrels, and Lukoil‘s daily ...

market analysis2025-10-23

The new U.S. restrictions on China hit the weak point of science and technology!

Markets remained relatively calm early Thursday, October 23, as investors avoided taking large positions while looking for the next big catalyst. Later in the day, the U.S. economic calendar will feature existing home sales and new home sales data. On Friday, ...

market analysis2025-10-23

Foreign exchange practical strategy on October 23

U.S. dollar index: The U.S. dollar index‘s rise on Wednesday was blocked below 99.15, and its decline was supported above 98.75, which means that the U.S. dollar is likely to maintain an upward trend after a short-term decline. If the U.S. index falls and stab...

market analysis2025-10-23

The "shutdown" continues, the U.S. Senate rejects the temporary appropriation bi

On October 23, in the Asian market on Thursday, spot gold was trading around US$4,080 per ounce. The price of gold fell to a nearly two-week low as investors took profits before the United States released key inflation data this week. US crude oil was trading ...

market analysis2025-10-23

Gold, not so fragile!

Yesterday, we once again saw that Shenzhen has raised the market value of listed companies to government requirements, striving to comprehensively improve the quality of listed companies in the area by the end of 2027, with the market value of domestic and ove...

market analysis2025-10-23

Silver rebounded after a sharp decline, and adjustments will be maintained in th

Silver rebounded from a two-week low to about $49 during the Asian session on Wednesday, after falling nearly 12% since Friday due to improved global trade expectations. The market is full of expectations for the upcoming meeting between U.S. President Trump a...

market analysis2025-10-23

Palm oil suffered from external drag, resulting in three consecutive negative ye

The Malaysian palm oil futures market continued its decline on Wednesday (October 22), closing lower for the third consecutive trading day. Significantly dragged down by the weak competitive vegetable oil prices in Dalian, the benchmark January contract FCPOc3...

market analysis2025-10-23

Oversold hammer hits the bottom, gold and silver are short and then long

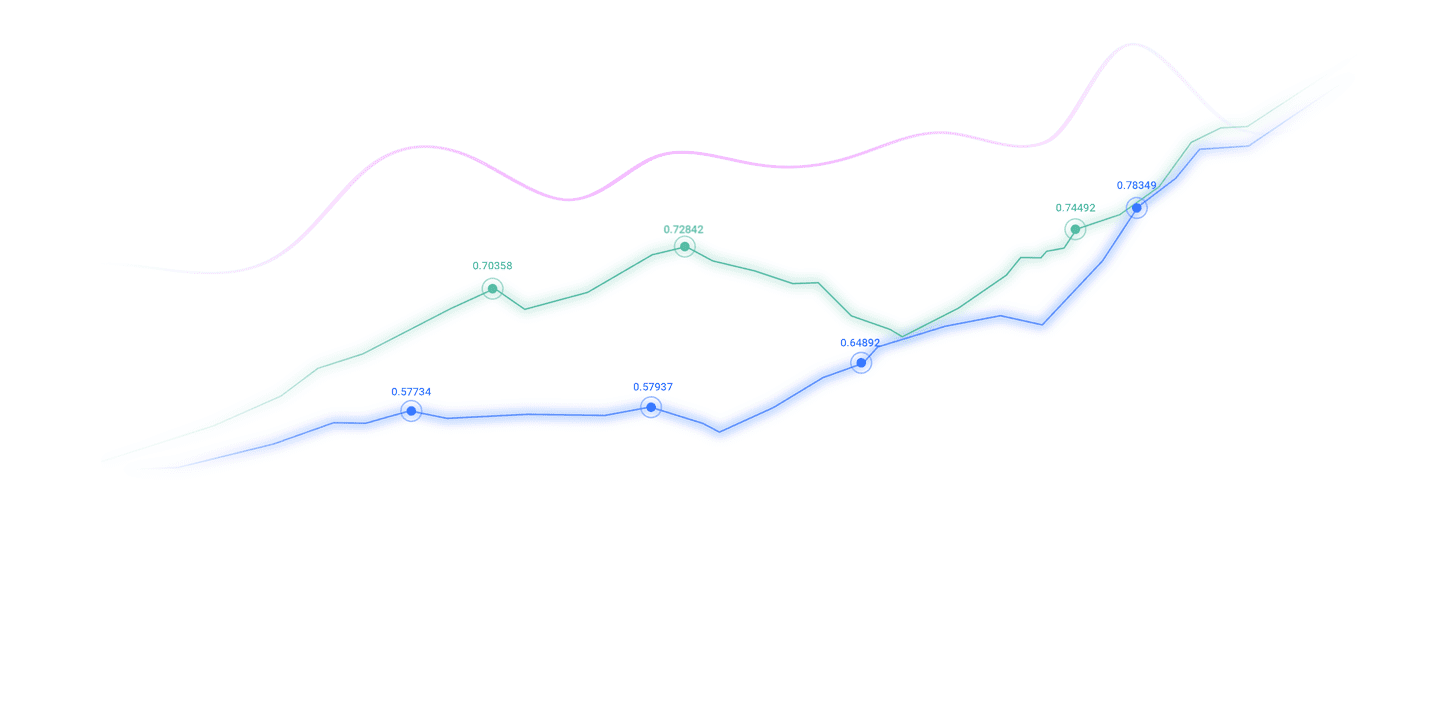

Yesterday, the gold market opened at 4125.4 in early trading and the market fell back in early trading. After the daily line reached the lowest position of 4002.7, the market was strongly supported by the hotline level Bollinger Track. After the daily line rea...

market analysis2025-10-23

A collection of good and bad news affecting the foreign exchange market

1. US dollar: Dovish signals strengthen the negative side, and hedging demand provides support and positive factors. The inflow of global hedging funds forms a periodic support. In September, global physical gold ETFs recorded the largest single-month inflow i...

market analysis2025-10-23

Oil prices rose more than 3%, gold prices fell to nearly two-week lows, the Unit

Basic news: On Thursday (October 23, Beijing time), spot gold was trading around $4,089 per ounce. Gold prices fell to a nearly two-week low as investors took profits before the United States released key inflation data this week. U.S. crude oil was trading ar...

market analysis2025-10-22

The U.S. government shutdown has dragged down the foreign exchange market. Analy

Global Market Overview 1. European and American market conditions The three major U.S. stock index futures all fell, with the Dow futures falling 0.00%, the S&P 500 futures falling 0.04%, and the Nasdaq futures falling 0.27%. Germany‘s DAX index fell by 0.21%,...

market analysis2025-10-22

Dollar recovers, pound falls on weak UK inflation data

Sterling weakened against major rivals earlier on Wednesday as markets assessed UK inflation data as weaker than expected. The economic calendar will not release any data that could have a major impact on the movements of major currency pairs mid-week. As a re...

market analysis2025-10-22

Gold, has the bull market turned around?

Gold‘s flash crash of 5% overnight was a "collision" between expectations and reality. Gold prices plummeted 5% in a single day, with prices falling rapidly from a high of $4,400, the largest single-day drop of the year. This sudden "flash crash" not only ende...

CATEGORIES

News

- Kewang Stocks continue to be strong, setting a new high for more than three year

- The latest trend analysis of the US dollar index, yen, euro, pound, Australian d

- US dollar index rises slightly, Trump clarifies "behind" gold tariffs

- Bearish pressure intensifies after the US dollar index falls below the 50-day mo

- The latest trend analysis of the US dollar index, yen, euro, pound, Australian d

- Guide to short-term operation of major currencies