Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- 【XM Decision Analysis】--S&P 500 Monthly Forecast: February 2025

- 【XM Group】--EUR/USD Forecast: Faces Key Test

- 【XM Forex】--USD/MXN Analysis: Calmer Trading Waters as Important U.S Data Looms

- 【XM Group】--AUD/USD Forecast: Continues to Look Damaged – Can it Bounce?

- 【XM Forex】--Gold Analysis: Gold Hits Record Highs Amid Tariff Uncertainty

market analysis

The US dollar index needs to rebound, soybean meal pigs will be slower

Wonderful introduction:

Since ancient times, there have been joys and sorrows, and since ancient times, there have been sorrowful moon and songs. But we never understood it, and we thought everything was just a distant memory. Because there is no real experience, there is no deep feeling in the heart.

Hello everyone, today XM Foreign Exchange will bring you "[XM Foreign Exchange Platform]: The US index needs to rebound, and the live pigs of soybean meal will be delayed and the long-term will be low." Hope it will be helpful to you! The original content is as follows:

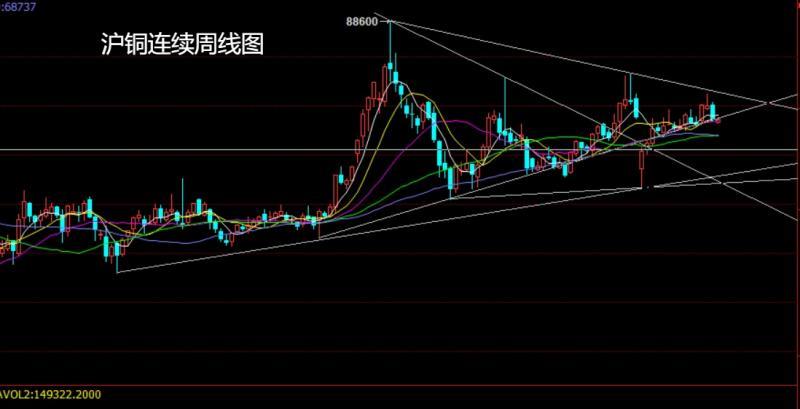

Last week, the Shanghai copper market opened at the 80076 position at the beginning of the week, and the market fell first, and then the market rose. The weekly line reached the highest position at 80348 and then fell strongly. The weekly line was given the lowest position at 78144 and then sorted out. After the weekly line finally closed at the 78560 position, the weekly line closed with a large negative line with a lower shadow line slightly longer than the upper shadow line. After this pattern ended, the short stop loss of 79450 this week, and the target was 78700 and 78500 and 78300.

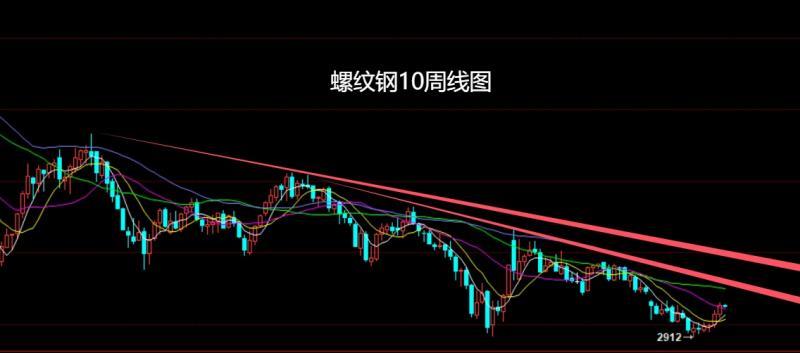

Last week, the rebar 10 market opened at the 3072 position at the beginning of the week, and the market fell first at the beginning of the week. The weekly line was at the lowest point of 3050 and then the market rose strongly. The weekly line reached the highest point of 3154 and then the market consolidated. The weekly line finally closed at the 3130 position and the market closed with a medium-positive line with a lower shadow line slightly longer than the upper shadow line. After this pattern ended, the weekly line was more than 3100 stop loss of 3085 this week, and the target was 3130 and 3155 and 3180.

The corn 09 market opened slightly lower last week at 2352 and then fell directly. The weekly line was at the lowest point of 2280 and then the market consolidated. The weekly line finally closed at 2283 and then the market was slightly lower.The long bald head has a large negative line closed, and after this pattern ends, the short stop loss of 2320 for 2300 this week, and the target below is 2280 and 2260 and 2245.

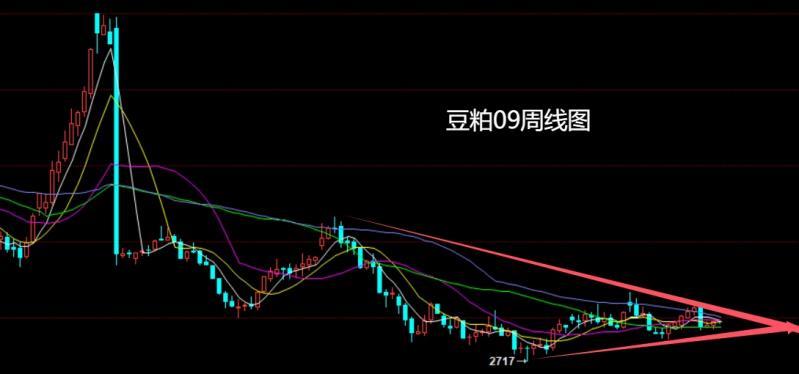

The soybean meal 09 market opened at 2955 last week and then fell first. The weekly line was at the lowest point of 2925 and then the market rose at the end of the trading session. The weekly line reached the highest point of 2987 and then the market consolidated. The weekly line finally closed at 2975 and then the market closed in a hammer head pattern with a long lower shadow line. After this pattern ended, the weekly line was more than 2960 and the stop loss was 2940 this week, and the target was 2990 and 3035 and 3075.

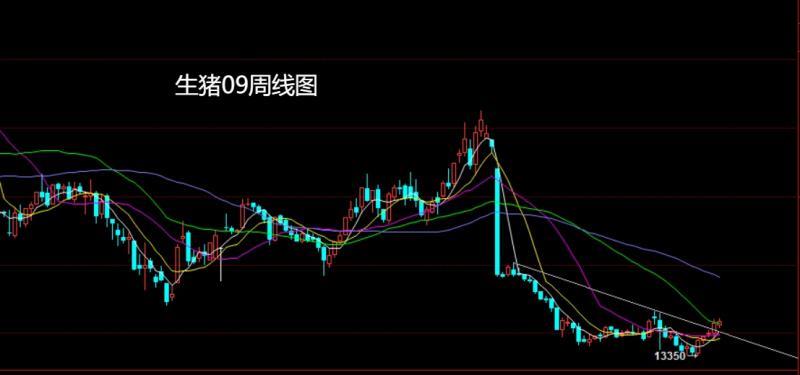

The live pig 09 market opened at 14254 last week and then fell first. The weekly line was at the lowest point of 14174 and then the market rose strongly. The weekly line reached the highest point of 14455 and then the market consolidated. The weekly line finally closed at 14345 and then the market closed with a spindle pattern with an upper and lower shadow line. After this pattern ended, the stop loss of 14250 this week was 14100, and the target was 14450 and 14650 and 14900.

PTA09 market opened at 4698 last week and then fell first. The weekly line was at the lowest point of 4669 and then the market fluctuated and rose. The weekly line reached the highest point of 4754 and then the market consolidated. The weekly line finally closed at 4738 and then the market closed in a spindle form. After this pattern ended, the stop loss of 4695 in more than 4710 this week, and the target was 4755 and 4800-4820.

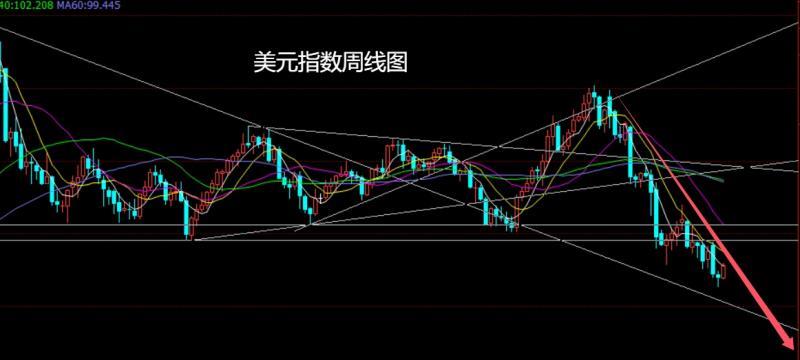

The US dollar index market opened at 96.987 last week and then the market fell slightly back to 96.911. The market rose strongly. The weekly line reached the highest point of 98.018 and then the market consolidated. The weekly line finally closed at 97.882. Then the market closed with a big positive line with a slightly shadow line. After this pattern ended, the US dollar index market had a long demand this week.

Fundamentals, the fundamental tariffs last week became the focus of the market again. The US President signed an executive order to extend the original deadline for tariff negotiations and the effective date of reciprocity from July 9 to August 1, and sent letters to more than 20 countries, unilaterally formulating tariffs ranging from 20%-50%, saying that if the negotiations are invalid, they will www.xmhouses.come into effect in August. Among them, Brazil faces a maximum tax rate of 50%, which Trump said was because of the countryThe investigation into former President Bolsonaro is "Witch Hunting Operation." Brazilian President Lula responded strongly that reciprocal retaliation would be carried out, and that Brazil could survive even without trade with the United States and would look for other trading partners. He also stressed that Brazil's trade with other countries does not need to rely on the US dollar and can be settled in local currency. It is planned to impose a 50% tariff on copper products to increase U.S. metal production. He also intends to impose tariffs of up to 200% on imported drugs, but gives drugmakers one year to adjust. The minutes of the Federal Reserve's June policy meeting show that there are obvious differences within the Federal Reserve on the next interest rate path. Some officials believe that a July rate cut is a reasonable move due to signs of weakness in the labor market and a moderate pull on prices by a new round of tariff shocks. They believe that the cost pressure brought by tariffs is mostly a one-time impact and will not change the market's long-term inflation expectations. On the crude oil side, OPEC+ is discussing the suspension of further increase in production from October after www.xmhouses.completing a supply recovery plan of about 2.2 million barrels per day in September. The group began to lift its production cut plan in April, increasing its production by 138,000 barrels per day that month, and increasing its production by 411,000 barrels per day from May to August respectively. Senior officials in Saudi Arabia, the UAE and Kuwait said the current new supply is in line with market demand. The fundamentals of this week are mainly focused on the trade accounts of China in June in 10:00 and the trade accounts of China in June in June. On Tuesday, we focused on China's second-quarter GDP annual rate at 10:00 a.m., with evening being the key to this week, focusing on the unseasonal adjustment of the CPI annual rate in June at 20:30. This round is expected to be 2.7% in the previous value of 2.4%. We focused on the 20:30 annual rate of June PPI in the United States and the 20:30 US June PPI in the United States. Then look at the monthly rate of industrial output in June at 21:15, and look at the monthly rate of EIA crude oil inventories from the U.S. to July 11 week at 22:30 and the U.S. Cushing crude oil inventories from the U.S. to July 11 week and the U.S. to July 11 week and the U.S. strategic oil reserve inventory from the U.S. to July 11 week. Focus on the final value of the Eurozone June CPI annual rate at 17:00 on Friday. The U.S. market was 20:30 in the U.S. to July 12, and the U.S. retail sales monthly rate in June, the U.S. Philadelphia Fed Manufacturing Index and the U.S. import price index monthly rate in June. Look at the NAHB real estate market index in July and the monthly rate of www.xmhouses.commercial inventory in May in the U.S. at 22:00 in the evening. On Friday, we will pay attention to the annualized total number of new homes in the United States in June and the total number of construction permits in the United States in June at 20:30. Look at the initial value of the expected one-year inflation rate in the United States at 22:00 a little later and the initial value of the University of Michigan Consumer Confidence Index in July.

In terms of operations, Shanghai copper has been continuously: 79250 short stop loss this week 79450, targeted at 78700 and 78500 and 78300.

Rebar 10: 3100 stop loss this week 3085, targeted at 3130 and 3155 and 3180.

Corricane 09: 2300 short stop loss this week, targeted at 2280 and 2260 and 2245.

Soybean meal 09: 2 this week960 stop loss is 2940, the target is 2990 and 3035 and 3075.

Pig 09: 14250 stop loss is 14100 this week, the target is 14450 and 14650 and 14900.

PTA09: 4710 stop loss is 4695 this week, the target is 4755 and 4800-4820.

The above content is all about "[XM Foreign Exchange Platform]: The US Index of Big Sun needs to rebound, soybean meal live pigs delay low and long", which is carefully www.xmhouses.compiled by the editor of XM Foreign Exchange. I hope it will be helpful to your trading! Thanks for the support!

After doing something, there will always be experience and lessons. In order to facilitate future work, we must analyze, study, summarize and concentrate the experience and lessons of previous work, and raise it to the theoretical level to understand it.

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here