Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- 【XM Market Review】--WTI Crude Oil Monthly Forecast: January 2025

- 【XM Market Analysis】--Gold Analysis: Holds Gains

- 【XM Market Analysis】--USD/JPY Forecast: US Dollar Bounces Against Japanese Yen

- 【XM Decision Analysis】--GBP/USD Forex Signal: Outlook Ahead of FOMC Decision

- 【XM Market Review】--EUR/USD Forecast: Euro Drops on Tariff News

market analysis

The hammer head in the weekly line rebounds, and gold and silver retracement continues to rise

Wonderful introduction:

Spring flowers will bloom! If you have ever experienced winter, then you will have spring! If you have dreams, then spring will definitely not be far away; if you are giving, then one day you will have flowers blooming in the garden.

Hello everyone, today XM Foreign Exchange will bring you "[XM Foreign Exchange Platform]: Weekly hammer heads will rebound, and gold and silver will continue to fall back and continue to rise." Hope it will be helpful to you! The original content is as follows:

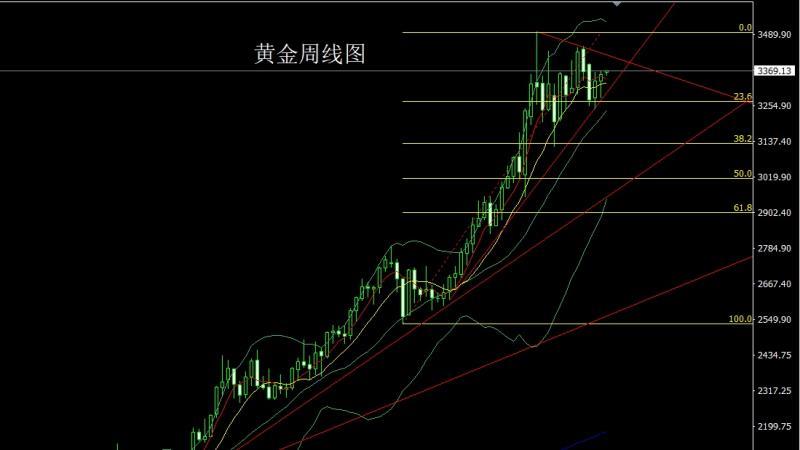

Last week, the gold market opened at the beginning of the week at 3337.6 and then the market fluctuated and fell sharply. After the weekly line was at the lowest point of 3282, the market fluctuated and rose strongly. By the Friday weekly line, the market closed with a very long hammer head pattern with a lower shadow line. After this pattern ended, the market continued to be bullish. At the point, today, 3358 stopped the loss 3353, and the target was 3375 and 3382 and 3390-3395.

The silver market opened higher at 37.154 last week and then fell strongly. The weekly line was at the lowest point of 36.12 and then the market rose strongly. After breaking the neckline pressure on Friday, the weekly line reached the highest point of 38.516 and then the market consolidated. The weekly line finally closed at 38.418 and then the market closed with a large positive line with a very long lower shadow line. After this pattern ended, the market continued to be bullish this week. At the point, the stop loss of 37.6 is 37.8 today, and the target is 38.5 and 39.3 and 39.5.

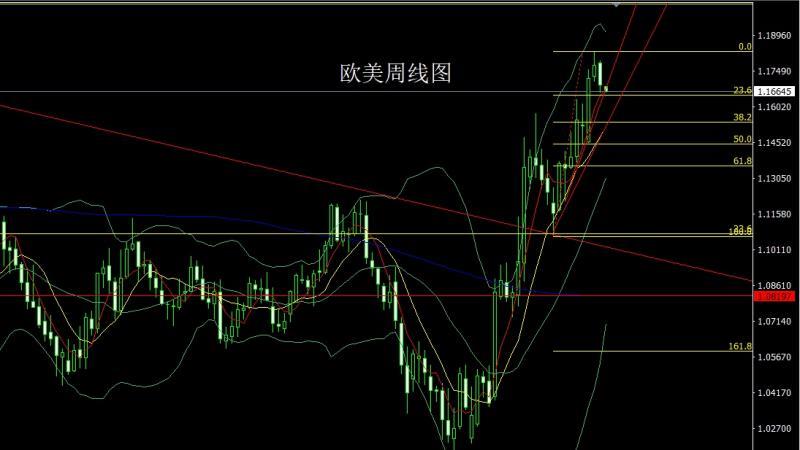

The European and American markets opened slightly higher last week at 1.17822 and then rose slightly, giving a position of 1.17901 and then falling back strongly. The lowest axis was given to the position of 1.16616.After the market was consolidated, the weekly line finally closed at 1.16919, and the weekly line closed with a large negative line with a long lower shadow line. After this pattern ended, the weekly line was negative and closed with a pressure signal of yang falling. At the point, the early trading first fell back by 1.16550 and stop loss of 1.16400, and the target was 1.16850 and 1.17200 and 1.17450.

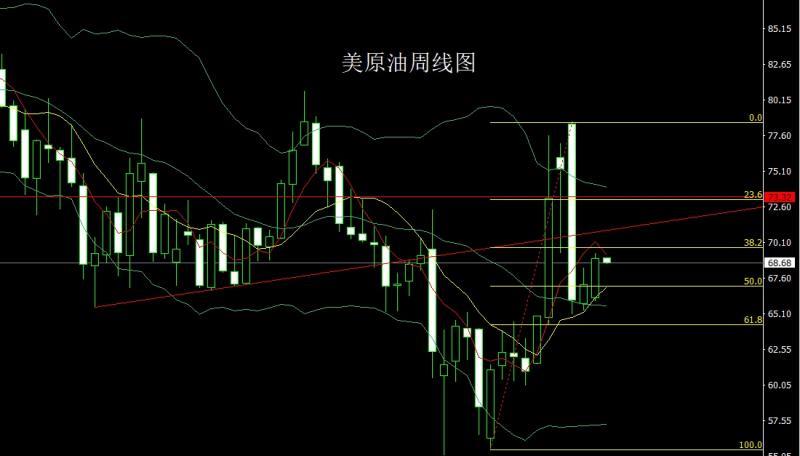

The US crude oil market opened lower at 66.17 last week and then the market fell slightly back to 65.94. The market fluctuated strongly. The weekly line reached the highest position of 69.32 and then the market fluctuated in the range. The weekly line finally closed at 68.94. The market closed with a medium-positive line with a slightly longer upper shadow line than the lower shadow line. After this pattern ended, today's 67.6 stop loss was 67.1. The target was 69 and 69.5 and 70.

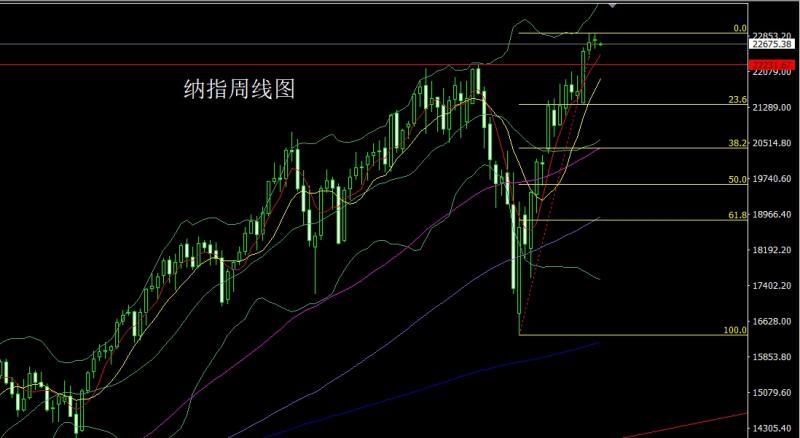

The Nasdaq market opened higher at 22770.2 last week and then rose slightly. The market fell. The weekly line was at the lowest point of 22576 and then the market fluctuated and rose. The weekly line reached the highest point of 22913.73 and then the market consolidated. The weekly line finally closed at 22757.53 and then the market closed with a cross star with an upper and lower shadow line. After this pattern ended, today 2 2780 short stop loss 22860, targeting 22700 and 22600 and 22550 and 22450.,

Basics, the fundamentals of the fundamentals became the focus of the market again last week. The US President signed an executive order to extend the original tariff negotiation deadline and the effective date of reciprocity from July 9 to August 1, and sent letters to more than 20 countries, unilaterally formulating tariffs ranging from 20%-50%, saying that if the negotiations are invalid, they will be implemented in August. Among them, Brazil faces a maximum tax rate of 50%, which Trump said was because the country's investigation into former President Bolsonaro was a "witch hunting operation." Brazilian President Lula responded strongly that reciprocal retaliation would be carried out, and that Brazil could survive even without trade with the United States and would look for other trading partners. He also stressed that Brazil's trade with other countries does not need to rely on the US dollar and can be settled in local currency. It is planned to impose a 50% tariff on copper products to increase U.S. metal production. He also intends to impose tariffs of up to 200% on imported drugs, but gives drugmakers one year to adjust. The minutes of the Federal Reserve's June policy meeting show that there are obvious differences within the Federal Reserve on the next interest rate path. Some officials believe that a July rate cut is a reasonable move due to signs of weakness in the labor market and a moderate pull on prices by a new round of tariff shocks. They believe that the cost pressure brought by tariffs is mostly a one-time impact and will not change the market's long-term inflation expectations. OPEC+ is currently discussing on crude oilAfter www.xmhouses.completing a supply recovery plan of about 2.2 million barrels per day in September, further production increases will be suspended from October. The group began to lift its production cut plan in April, increasing its production by 138,000 barrels per day that month, and increasing its production by 411,000 barrels per day from May to August respectively. Senior officials in Saudi Arabia, the UAE and Kuwait said the current new supply is in line with market demand. The fundamentals of this week are mainly focused on the trade accounts of China in June in 10:00 and the trade accounts of China in June in June. On Tuesday, we focused on China's second-quarter GDP annual rate at 10:00 a.m., with evening being the key to this week, focusing on the unseasonal adjustment of the CPI annual rate in June at 20:30. This round is expected to be 2.7% in the previous value of 2.4%. We focused on the 20:30 annual rate of June PPI in the United States and the 20:30 US June PPI in the United States. Then look at the monthly rate of industrial output in June at 21:15, and look at the monthly rate of EIA crude oil inventories from the U.S. to July 11 week at 22:30 and the U.S. Cushing crude oil inventories from the U.S. to July 11 week and the U.S. to July 11 week and the U.S. strategic oil reserve inventory from the U.S. to July 11 week. Focus on the final value of the Eurozone June CPI annual rate at 17:00 on Friday. The U.S. market was 20:30 in the U.S. to July 12, and the U.S. retail sales monthly rate in June, the U.S. Philadelphia Fed Manufacturing Index and the U.S. import price index monthly rate in June. Look at the NAHB real estate market index in July and the monthly rate of www.xmhouses.commercial inventory in May in the U.S. at 22:00 in the evening. On Friday, we will pay attention to the annualized total number of new homes in the United States in June and the total number of construction permits in the United States in June at 20:30. Look at the initial value of the expected one-year inflation rate in the United States at 22:00 a little later and the initial value of the University of Michigan Consumer Confidence Index in July.

In terms of operation, gold: 3358 today's long stop loss 3353, target 3375 and 3382 and 3390-3395.

Silver: 37.8 today's long stop loss 37.6, target 38.5 and 39.3 and 39.5.

Europe and America: first fell back 1.16550 and 1.16400 in the morning, target 1.16850 and 1.17200 and 1.17450.

< p>US crude oil: 67.6 long stop loss today 67.1. Target 69 and 69.5 and 70.Nasdaq: 22780 short stop loss today 22860, target 22700 and 22600 and 22550 and 22450.

The above content is all about "[XM Foreign Exchange Platform]: Weekly hammer heads prolong rebound, gold and silver retracement continues to be long", which was carefully www.xmhouses.compiled and edited by the editor of XM Foreign Exchange. I hope it will be helpful to your trading! Thanks for the support!

Only the strong know how to fight; the weak are not qualified to fail, but are born to be conquered. Step up to learn the next article!

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here