Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- The US dollar index is expected to form a "head and shoulder bottom" bottom stru

- Chinese online live lecture this week's preview

- Starting in September, gold hits a new high?

- Practical foreign exchange strategy on August 25

- The U.S.-European trade prospects suppress gold prices, and the impact of the U.

market analysis

Employment collapse pushes risk aversion, gold and silver are inverted and more after being hollowed out

Wonderful introduction:

Life needs a smile. When you meet friends and relatives, you can give them a smile, which can inspire people's hearts and enhance friendship. When you receive help from strangers, you will feel www.xmhouses.comfortable with both parties; if you give yourself a smile, life will be better!

Hello everyone, today XM Foreign Exchange will bring you "[XM Foreign Exchange Market Analysis]: Employment collapse pushes risk aversion, and gold and silver are inverted and more after being hummed." Hope it will be helpful to you! The original content is as follows:

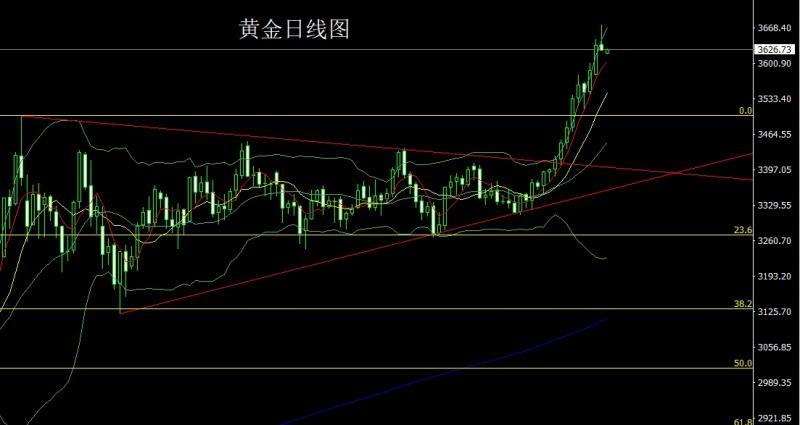

Yesterday, the gold market surged and fell. After the opening of the morning session at 3636.1, the market first fell, and then the market fluctuated and rose strongly. At the beginning of the US session, the daily line reached the highest position of 2374.7 and then the market fluctuated and fell strongly. The daily line was at the lowest position of 3625.2 and then closed. The daily line closed with an extremely long inverted hammer head pattern with an ending shape. After such a pattern ended, the daily line took short-term profits to close the signal, and the market was short-term. Adjust demand, at the point, the long position of 3325 and 3322 below and the long position of 3368-3370 last week and the long position of 3377 and 3385 last week followed by the stop loss following at 3450. The long position of 3563 last Friday followed at 3570. The long position of 3603 on the day before yesterday left the market in the early trading. Today, 3645 tried to short 3647 short, stop loss 3651. The target below looked at the support of 3625 and 3618 and 3610, and if it fell below, it looked at the range of 3600-3592.

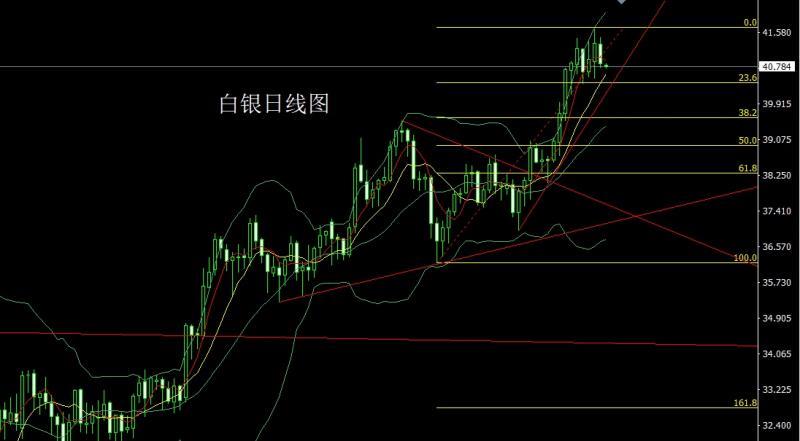

The silver market opened at 41.31 yesterday and then the market fell back to 41.194. The market rose. The daily line reached the highest point of 41.479 and then the market fluctuated and fell. The daily line was at the lowest point of 40.758 and then the market consolidated. After the daily line finally closed at 40.855, the daily line closed with a large negative line with an upper shadow line slightly longer than the lower shadow line.After the pattern ended, there is a demand for consolidation in today's market. At the point, the long position at 37.8 below and the long position at 38.8 last Friday, the stop loss followed at 39.5. Today, the short stop loss at 41.15 today is 40.7 and 40.5 and 40.3-40.1.

European and American markets opened at 1.17604 yesterday and the market first rose to 1.17802, and then the market fluctuated strongly. The daily line was at the lowest point of 1.17028 and then the market consolidated. The daily line finally closed at 1.17090 and then the market closed with a large negative line with a longer upper shadow line. After this pattern ended, the daily line was yin and yang. Today's market was 1.17400 short stop loss 1.17600. The target below was 1.17000 and 1.16800 and 1.16500.

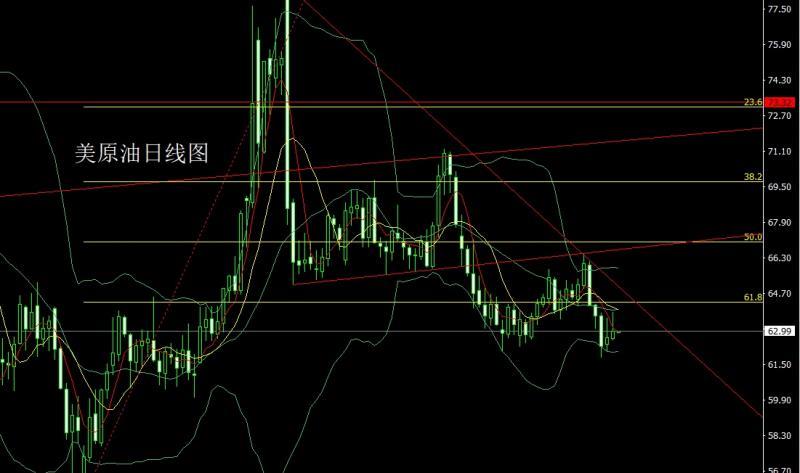

The US crude oil market opened at 62.65 yesterday and then fell back. The market fluctuated strongly. The daily line reached the highest point of 63.87 and then the market surged and fell. After the daily line finally closed at 62.99, the daily line closed in an inverted hammer head with a long upper shadow line. After this pattern ended, the daily line was continuously under pressure. At the point, the short stop loss of 64.1 today is 63.6, and the target below is 62.95 and 62.5, and the break below is 62.2 and 62.

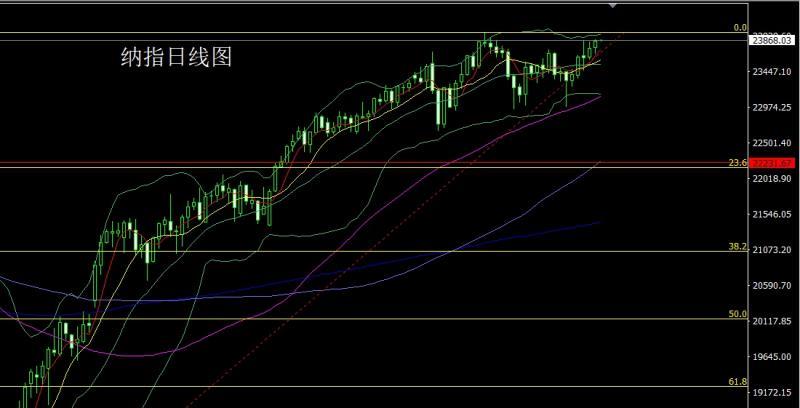

The Nasdaq market opened at 23767.38 yesterday and the market rose first and gave the position of 23851.05. Then the market fell rapidly. The daily line was at the lowest point of 23690.58. The market rose strongly. The daily line reached the highest point of 23882 and then the market consolidated. After the daily line finally closed at 23855.63, the daily line closed with a slightly longer mid-positive line. After this pattern ended, the stop loss of more than 23800 today was 23750, and the target was 23900 and 23950-24000.

< p>Brands, yesterday's fundamentals, the US Supreme Court heard the US president's tariff appeal case, and the debate was scheduled in early November. The US employment data was significantly revised, and the jobs will be revised down by 911,000 for the first 12 months to March. Such poor non-agricultural employment means that the collapse of the US economy has substantially increased. The Federal Reserve must have a difficult choice to take into account the employment first, and the probability of taking the two harms is increased. The Federal Reserve will not understand the principle of taking the lighter, so gold rose rapidly after the data, but the short-term rapid rise hit the expected high pressure, and the market took profits in the late trading. Today's fundamentals are the mainPay attention to China's August CPI annual rate at 9:30, look at the US August PPI annual rate at 20:30 in the evening and the US August PPI monthly rate at 22:00 in the evening, look at the US July wholesale sales monthly rate at 22:30 in the week from the United States to September 5, and the US Cushing crude oil inventories in the week from the United States to September 5, and the US strategic oil reserve inventory inventories in the week from the United States to September 5.In terms of operation, gold: the long positions of 3325 and 3322 below and the long positions of 3368-3370 last week, and the stop loss followed by 3450 after reducing positions. The stop loss followed by 3570 after reducing positions last Friday, and the long positions of 3603 on the day before yesterday left the market in the early trading. Today, 3645 tried to short positions conservatively 3647 short positions, stop loss 3651, and the target below looks at the support of 3625 and 3618 and 3610, and if it falls below, look at the range of 3600-3592.

Silver: The long at 37.8 below and the long at 38.8 last Friday, the stop loss followed up at 39.5. Today, the short stop loss is 41.15 today, the target below is 40.7 and 40.5 and 40.3-40.1.

Europe and the United States: Today's market 1.17400 short stop loss 1.17600, the target below is 1.17000 and 1.16800 and 1.16500.

US crude oil: Today's 63 .6 short stop loss 64.1, the target below is 62.95 and 62.5, and the target below is 62.2 and 62.

Nasdaq: Today is 23,800 stop loss 23,750, the target is 23,900 and 23,950-24,000.

The above content is all about "[XM Foreign Exchange Market Analysis]: Employment collapse pushes risk aversion, gold and silver are inverted and hammered long after being short", which is carefully www.xmhouses.compiled and edited by the editor of XM Foreign Exchange. I hope it will be helpful to your trading! Thanks for the support!

Every successful person has a beginning. Only by having the courage to start can you find the way to success. Read the next article now!

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here