Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- Eagle and bear share Ukraine, with gold and silver empty after the Yin and Yang

- The dollar falls as focus turns to inflation data and Sino-US trade negotiations

- A collection of positive and negative news that affects the foreign exchange mar

- Powell hits five-week highs after criminal charges from Trump allies, stimulatin

- The U.S.-European trade prospects suppress gold prices, and the impact of the U.

market news

Consolidation at a high level is waiting for inflation, gold and silver range is low

Wonderful introduction:

Optimism is the line of egrets that are straight up to the blue sky, optimism is the thousands of white sails beside the sunken boat, optimism is the lush grass that blows with the wind on the head of the parrot island, optimism is the falling red spots that turn into spring mud to protect the flowers.

Hello everyone, today XM Foreign Exchange will bring you "【XM Group】: Consolidation at a high level waiting for inflation, gold and silver range is low and long." Hope it will be helpful to you! The original content is as follows:

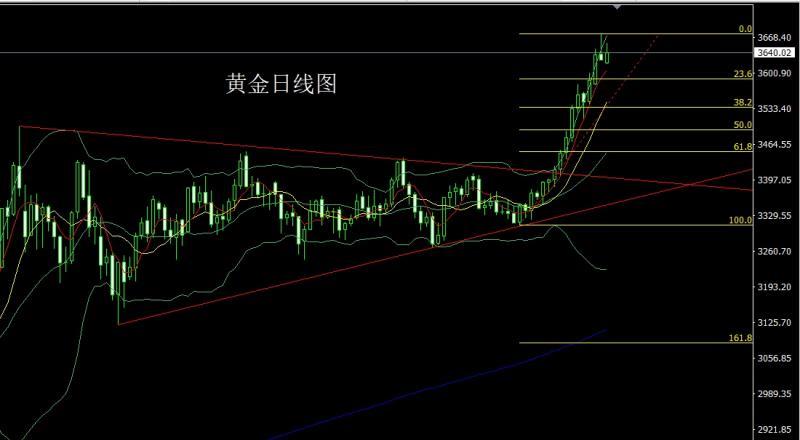

Yesterday, the gold market opened low at 3620 in the morning and then the market fell slightly and then gave the position of 3619. The market fluctuated and rose, and gave the position of 3640.9. The market fell back twice and gave the position of 3620.2. The market rose strongly. The hourly level broke through 3641 and made a double bottom. The market quickly rose. The daily line reached the highest position of 3657.7 and then consolidated at a high level. The daily line finally closed at 3640 and the upper shadow line with a very long upper shadow line closed. After this pattern ended, There is a long demand for today's market. At the point, the long 3325 and 3322 below are the long and the long 3368-3370 last week are long and the long 3377 and 3385 long and the stop loss follow up at 3450. Last Friday, the stop loss follow up at 3570. Today, the 3626 long and 3623 long stop loss 3619 are the long and the target is the pressure of 3645 and 3652 and 3658 and 3667 and 3674. If the breaking of the market after the evening data will hit the height of 3700

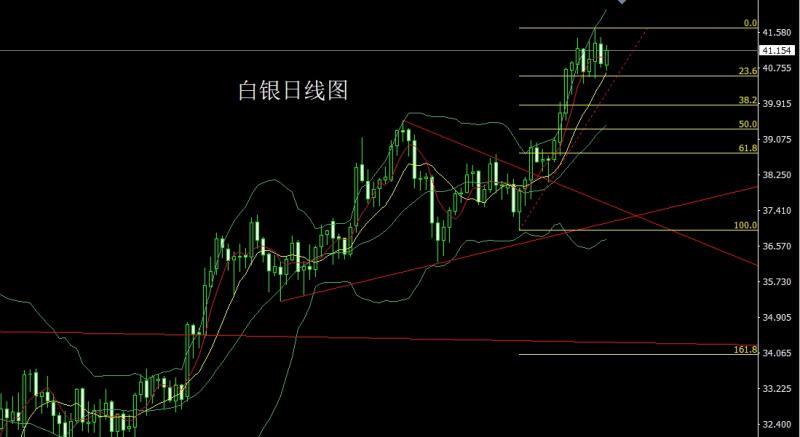

Yesterday, the silver market opened at 40.821 in the morning and then the market fell first. The daily line was at the lowest point of 40.697 and then the market rose strongly. The daily line reached the highest point of 41.276 and then the market consolidated. The daily line finally closed at 41.154 and then the market closed with a medium-positive line with an upper and lower shadow line. After this pattern ended, today's market demand was bullish.At the point, the long position at 37.8 below and the long position at 38.8 last Friday after reducing positions, the stop loss followed at 39.5, and the stop loss at 40.95 today is 40.95 long position at 40.75, and the target is 41.25 and 41.5 and 41.7-41.9.

European and American markets opened at 1.17059 yesterday and the market fell first. The daily line was at the lowest point of 1.16815 and then the market rose rapidly. The daily line reached the highest point of 1.17305 and then the market consolidated. The daily line finally closed at 1.16945 and then the market closed in an inverted hammer head with a long upper shadow line. After this pattern ended, today's short stop loss of 1.17200 is 1.17400. The target below is 1.16800 and 1.16600 to leave the market.

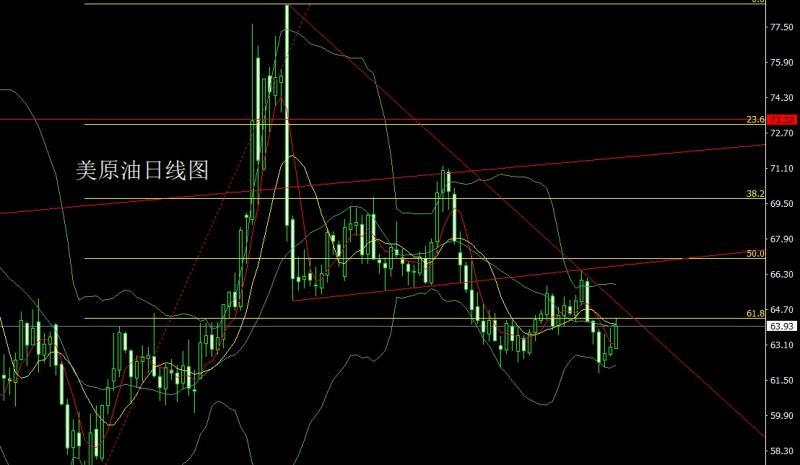

The US crude oil market opened at 62.93 yesterday and the market fell slightly back. After the market fluctuated strongly. The daily line reached the highest position of 64.28 and then the market was under pressure and consolidated. The daily line finally closed at 63.93 and then the market closed with a large positive line with a longer upper shadow line. After this pattern ended, today's market was 63.4 and 62.9, with a target of 64 and 64.3 and 64.8 and 65-65.5.

The Nasdaq market opened at 23870.5 yesterday and the market stretched first to give the position of 24010.41, and then the market fell rapidly. The daily line was at the lowest point of 23751.49, and the market consolidated. The daily line finally closed at 23829.95. Then the market closed in a spindle pattern with an upper shadow slightly longer than the lower shadow. After this pattern ended, 23950 tried to short stop loss of 24020 today, and the target below looked at 22800 and 22700 and 22650.

The fundamentals, yesterday's fundamentals were the annualized PPI rate of the United States in August recorded 2.6%, a new low since June. Traders have stepped up bets on the Fed's interest rate cut. The US PPI fell unexpectedly. The US President said that Powell must immediately cut interest rates significantly, so yesterday the gold market was supported and fluctuated and rose. Today's fundamentals are the key to this week. We mainly focus on the euro zone at 20:15 to September 11, the European Central Bank deposit mechanism interest rate at 20:30 US session. The US unseasonal adjustment of the annual CPI rate in August and the number of initial unemployment claims in the United States to September 6th. This round is expected to be 2.9% and 235,000 people. European Central Bank President Lagarde, who saw 20:45 a little later, held a press conference on monetary policy.

Operation, gold: 3325 and 3322 belowLast week, the long and 3377 and 3385 long positions were last week, and the stop loss followed by 3450. Last Friday, the stop loss followed by 3563 long positions were last week, and the stop loss followed by 3570. Today, the 3626 long positions were conservative and the 3623 long stop loss was 3619. The target is 3645 and 3652 and 3658 and 3667 and 3674 pressures. If the breaking level after the evening data will hit the 3700 height.

Silver: The long at 37.8 below and the long at 38.8 last Friday, the stop loss followed up at 39.5, and the stop loss was 40.75 today, with a target of 41.25 and 41.5 and 41.7-41.9.

Europe and the United States: Today's short stop loss of 1.17200 today. The target below is 1.16800 and 1.16600 to leave the market and prepare for long.

U.S. crude oil: Today's market is 63.4 long stop loss 62.9, target 64 and 64.3 and 64.8 and 65-65.5.

Nasdaq: Today's 23950 try short stop loss 24020, and target below 22800 and 22700 and 22650.

The above content is all about "[XM Group]: High consolidation is waiting for inflation, gold and silver range is low". It is carefully www.xmhouses.compiled and edited by the editor of XM Forex. I hope it will be helpful to your trading! Thanks for the support!

In fact, responsibility is not helpless, it is not boring, it is as gorgeous as a rainbow. It is this colorful responsibility that has created a better life for us today. I will try my best to organize the article.

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here