Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- Trump angrily scolds Fed Chairman Powell for being a "fool"

- Gold rises to two-week highs, potentially hitting the $3,400 mark

- Guide to short-term operations of major currencies on July 24

- Gold is short in the morning session at 3358!

- A collection of positive and negative news that affects the foreign exchange mar

market analysis

The European Central Bank keeps interest rates unchanged, and analysis of short-term trends of spot gold, silver, crude oil and foreign exchange on September 11

Wonderful introduction:

Since ancient times, there have been joys and sorrows, and since ancient times, there have been sorrowful moon and songs. But we never understood it, and we thought everything was just a distant memory. Because there is no real experience, there is no deep feeling in the heart.

Hello everyone, today XM Foreign Exchange will bring you "[XM Official Website]: The European Central Bank maintains interest rates unchanged, and the short-term trend analysis of spot gold, silver, crude oil and foreign exchange on September 11". Hope it will be helpful to you! The original content is as follows:

Global Market Review

1. European and American market trends

The three major U.S. stock index futures rose, Dow futures rose 0.24%, S&P 500 futures rose 0.24%, and Nasdaq futures rose 0.29%. The German DAX index rose 0.21%, the UK FTSE 100 index rose 0.47%, the French CAC40 index rose 0.84%, and the European Stoke 50 index rose 0.38%.

2. Interpretation of market news

The European Central Bank maintains interest rates unchanged and raises economic growth expectations this year

⑴ The European Central Bank maintains the three key interest rates unchanged, with the deposit mechanism interest rate of 2.00%, the main refinancing interest rate of 2.15%, and the marginal loan interest rate of 2.40%, which meets market expectations. ⑵ The medium-term target of inflation is close to 2%, and the outlook is basically consistent with the June forecast. ⑶The latest forecast shows that the average overall inflation rate in 2025 was 2.1%, fell to 1.7% in 2026, and rose slightly to 1.9% in 2027. ⑷ Core inflation (excluding food and energy) is expected to reach 2.4% in 2025, 1.9% in 2026, and 1.8% in 2027. ⑸ Economic growth expectations have been raised, with the growth rate rising from 0.9% to 1.2% in 2025, slowing to 1.0% in 2026, and rebounding to 1.3% in 2027. ⑹The Management www.xmhouses.committee reiterates its www.xmhouses.commitment to stabilize medium-term inflation at 2%, emphasizing a prudent, meeting-by-session decision-making approach. ⑺ Interest rate decisions will continue to reflect inflation dynamics, risks and policy transmission effects, and do not www.xmhouses.commit specific paths in advance.

Citi CEO is optimistic about the prospects of M&A business, saying the U.S. economy is unlikely to decline

Citi CEO said M&A activity is rebounding as U.S. businesses gain confidence from clearer policy signals and the world's largest economy is unlikely to experience recession. With clearer policies on taxes, tariffs and deregulation, clients have become “much more active” in capital markets, investments and trading activities, Jane Fraser said in an interview. She said: "Our customer base is really starting to take action with confidence."

The fog of inflation: the number of interest rate cuts in the market, and the US dollar is surging in undercurrents

⑴ The market generally expects that at the September meeting, it is a foregone conclusion that at the meeting, the federal funds rate cut by 25 basis points, and there is even a slight risk of a 50 basis point cut. However, at present, the impact of the US Consumer Price Index (CPI) data on future policy trends is more critical. ⑵ Data shows that the market currently expects to have a 67 basis points rate cut this year, which makes the interest rate cuts two or three times the focus of debate among traders, and the upcoming CPI data will directly affect this expectation. ⑶ The production price index (PPI) data released yesterday showed a downward trend that exceeded expectations, which indicates that the upcoming CPI data may also perform weakly. If the CPI data is biased again, it will greatly enhance the market's bet on three interest rate cuts this year. ⑷ Although market expectations for interest rate cuts have risen, the downward trend of the US dollar index does not seem to have changed. Before the Federal Foundation meeting, the pressure of the US dollar depreciation still exists, and inflation data will be the key variable that determines the future direction of the US dollar.

The Ukrainian Central Bank has maintained the interest rate of 15.5% for the fourth consecutive time

⑴ The Ukrainian Central Bank decided to maintain the policy interest rate of 15.5% on September 11, 2025, and has held steady for four consecutive meetings. ⑵ The central bank said that the current policy stance will help maintain moderate monetary conditions, support the stability of the foreign exchange market and guide inflation towards the 5% target. ⑶ Consumer prices rose 13.2% year-on-year in August, slowing down for three consecutive months. The new season crop market eased some pressure but inflation was still at a high level. ⑷ The central bank expects inflation to fall further, reflecting the impact of the new quarter's harvest and the effectiveness of measures such as maintaining the attractiveness of hryvnia assets.

IMF predicts that Ukraine's funding gap will reach US$20 billion by 2027

The International Monetary Fund has determined that Ukraine's funding demand in the next two years may be US$20 billion higher than the Kiev government estimates. Meanwhile, negotiations to ensure the next round of aid plan are about to begin. According to a person familiar with the matter, the above differences arose when IMF staff held a meeting in Kiev last week to discuss external financing issues in 2026 and 2027. Reconciling these differences is crucial before the Washington-based IMF considers Ukraine’s request for a new loan plan, as Ukraine’s current funding is about to run out. If the IMF's estimates are correct, Kiev may need billions of dollars in additional financial support from Western allies every year to maintain the response to the Russian-Ukrainian conflict.

The Serbian Central Bank maintained the benchmark interest rate at 5.75% unchanged

⑴ The Serbian Central Bank maintained the benchmark interest rate at 5.75% unchanged, and the decision was based on the current and expected inflation levels and domestic and international economic conditions. ⑵ Overall inflation accelerated to 4.9% in July, mainly driven by the prices of food and non-alcoholic beverages, and the core inflation rate remained at 4.7%. ⑶ The central bank expects that under the influence of government temporary trade regulations, inflation will ease in September and remain in the target range by the end of the year, and will further slow down in 2026. ⑷ The GDP growth rate in the first half of the year reached 2%, with support from the expansion of the service industry and manufacturing industry, automobile investment and the infrastructure projects of the "2027 Serbia World Expo". ⑸ The unemployment rate fell to 8.5% in the second quarter of 2025 (the previous value was 9.1%). ⑹ The central bank emphasized that it will continue to monitor data changes and adjust monetary policies if necessary to maintain financial stability and economic growth.

Türkiye cut interest rates by 250 basis points to 40.5% beyond expectations

⑴Turkey Central Bank cut the benchmark interest rate by 250 basis points to 40.5%, exceeding market expectations to 41%. ⑵ Core inflation showed signs of slowing down in August, but food and service prices still put inflationary pressure. ⑶ Although economic growth exceeded expectations in the second quarter, weak domestic demand continued to form a deflationary environment. ⑷ The decision-maker emphasized that it will maintain a tight monetary policy until price stability is achieved and play a role through demand, exchange rates and expectations channels. ⑸ The www.xmhouses.committee will carefully evaluate policy pace based on inflation trends and medium-term goals. If inflation significantly deviates from the target, space for tightening will be retained. ⑹ Policy decisions are guided by a predictable, transparent and data-driven framework and are www.xmhouses.committed to achieving the medium-term 5% inflation target. ⑺The overnight loan interest rate was simultaneously lowered by 250 basis points to 43.5%, and the overnight loan interest rate dropped to 39%.

Romanian bond auction: yields rise, market sentiment is cautious

⑴Romania successfully issued the planned bonds of 300 million (approximately US$69.11 million) for July 2040 and 400 million bonds of 400 million in April 2028. Data shows that the average transaction yields of this auction were 7.67% and 7.60% respectively. www.xmhouses.compared with the last auction in August, the average yields of both types of bonds rose, rising from 7.26% and 7.39% respectively. ⑵ Although the issuance scale meets expectations, the average yield of this bond has risen by about 0.41% and 0.21% www.xmhouses.compared with the auction in August, indicating changes in the market's expectations for the interest rate environment. In addition, the bid multiple of the 2040 bond in July fell from 2.99 to 2.10 last time, and the bid multiple of the 2028 bond in April rose slightly from 2.08 to 2.23. This may reflect that investors' preferences for different maturity bonds under the current environment, and also imply that the market is digesting uncertainty. ⑶ The results of this auction, especially the rise in yields, may be related to current investors' cautious attitude towards the European Central Bank policy and before the release of U.S. inflation data. The market is paying close attention to the upcoming announcementU.S. inflation data, and whether the ECB will provide more guidance on future interest rate paths, may affect short-term trends in bond markets, especially as portfolio adjustments and risk appetite changes.

Indonesia's 2026 financial case hit the 3% deficit red line, and the market smelled variables

⑴ Indonesia's new Finance Minister Purbaya Yudi Sadwa said that in order to calm concerns about possible increase in local taxes, regional transfer payment funds in the 2026 fiscal budget are expected to increase. ⑵ The country's parliament is considering a draft budget of up to US$236 billion, which is expected to account for 2.48% of GDP and regional transfer payments of 650 trillion rupiah (about US$39.5 billion), a decrease of about 25% from 2025, a decade low. ⑶ Previously, Indonesia's Deputy Finance Minister said that the 2026 budget deficit may approach the statutory upper limit of 3%, highlighting the potential space for budget adjustment. ⑷Purbaya pointed out that given that the Parliament has not passed the budget, it is "very likely" to modify it and may "fine-tune" the fiscal deficit in 2026. ⑸ The market is generally concerned about whether the government's budget policy will deviate from the prudent track in the context of current President Prabowo Subianto, especially after the dismissal of the former Finance Minister, investors' concerns about fiscal discipline have heated up.

Bond yields quietly rise, and market sentiment is tense

⑴ The European Central Bank (ECB) policy meeting is approaching with the US inflation data, and market sentiment turns to cautious, resulting in a slight increase in the euro zone government bond yields. Germany's 10-year government bond yield rose 0.5 basis points to 2.66%, hitting a three-month high of 2.80% last week. The 2-year treasury bond yield is more sensitive to central bank policy expectations, rising 1.5 basis points to 1.97%. ⑵ Although the market generally expects the ECB to keep interest rates unchanged, U.S. economic data, especially inflation data, may reshape expectations of the Fed's policy path, especially after last week's disappointing employment data. Some analysts believe that the European Central Bank may retain the possibility of further easing. ⑶ Market pricing shows that by June 2026, the probability of the European Central Bank cutting interest rates by 25 basis points is 65%, and the deposit convenience rate reaches 1.9% by the end of 2026. Analysts pointed out that the Fed's easing cycle and its impact on the exchange rate may prompt the ECB to further cut interest rates. ⑷ The political situation in France may become more www.xmhouses.complicated, which may prompt the ECB to avoid taking an overly hawkish stance. The yield gap between France's 10-year treasury bonds and German treasury bonds widened to 79 basis points, reflecting the market's requirement for the risk premium for holding French debt. ⑸ Institutions predict that ECB President Lagarde will face more questions about the situation in France rather than the European Central Bank policy and whether emergency measures have been formulated to manage sovereign spreads to prevent sudden tightening of financial conditions. During the London trading session, the benchmark 10-year Treasury yield rose 1.5 basis points to 4.05%.

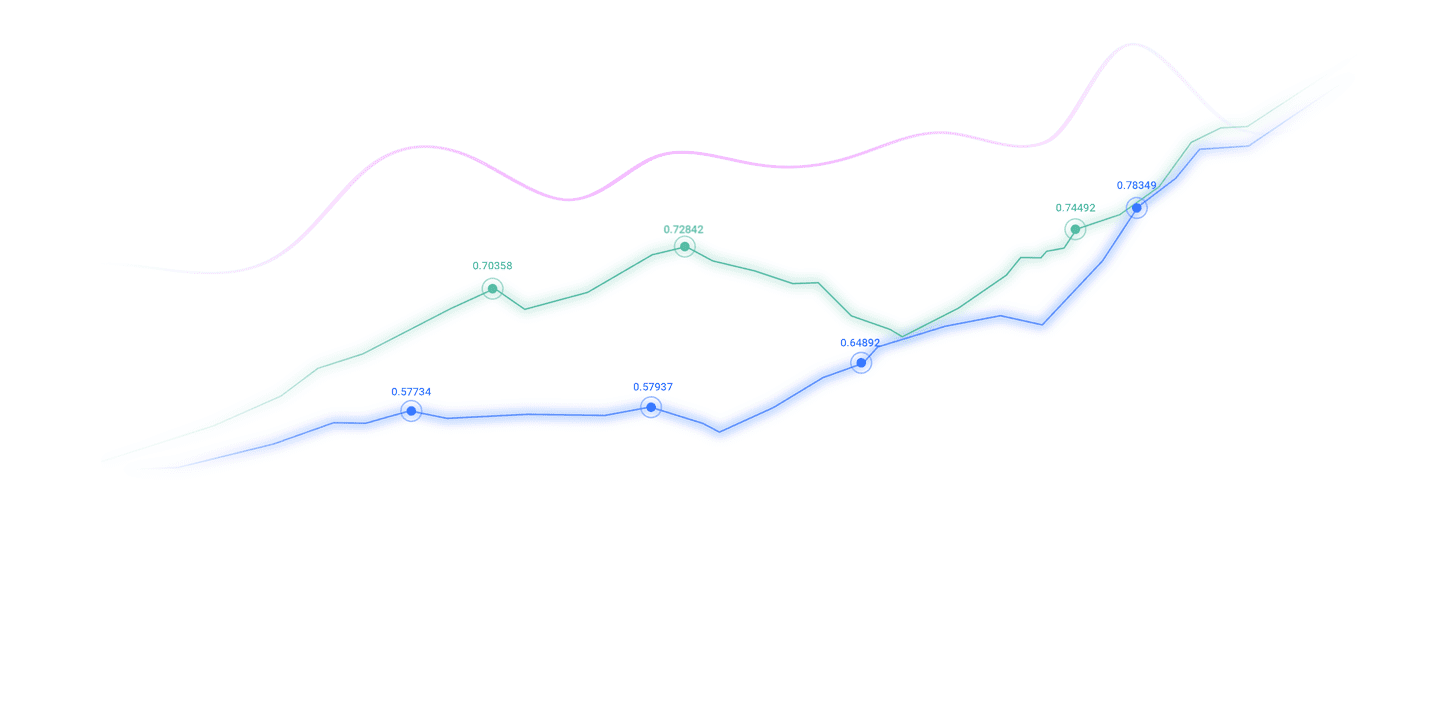

3.The trend of major currency pairs in the New York Stock Exchange before the market

Euro/USD: As of 20:23 Beijing time, the euro/USD rose, and is now at 1.1711, an increase of 0.13%. Before the New York Stock Exchange, the (Euro-USD) price continued to decline on the last trading day despite reaching oversold levels, exceeding the EMA50 support, exhausting positive opportunities that could support its recovery to rely on the support of the short-term bullish trend line as the last attempt to get the positive momentum needed to recover.

GBP/USD: As of 20:23 Beijing time, GBP/USD rose, now at 1.3542, an increase of 0.10%. Before New York, (GBPUSD) price fell on the last trading day as it attempted to get bullish momentum that could help it recover and rise again, as the main bullish trend dominated in the short term and traded along a slash, positive pressure from trading above the EMA50 continued. On the other hand, we noticed that (RSI) has shown negative signals after successfully getting rid of its oversold state, which temporarily hinders the price recovery.

Spot gold: As of 20:23 Beijing time, spot gold fell, now at 3639.49, a drop of 0.05%. Before the New York Stock Market, the (gold) price fell in the last trade at the intraday level as it attempts to find an upward low as it bases it may help it get the desired positive recovery momentum as the main bullish trend dominates in the short term and after reaching oversold levels, it trades along a slash, showing positive overlapping signals on (RSI), indicating the end of the negative momentum and the beginning of the near-term trend.

Spot silver: As of 20:23 Beijing time, spot silver fell, now at 41.108, a drop of 0.06%. Before New York, the (silver) price rose on the last trading day as it leaned on the EMA50 and gained some positive momentum, which helped it realize these gains, dominant on a short-term basis, and it traded along the supportive bias line of the trend, and on the other hand, negative signals from (RSI) remained, slowing its final gains.

Crude oil market: As of 20:23 Beijing time, U.S. oil fell, now at 62.810, a drop of 1.37%. New York CityBefore the market, crude oil prices fell in the last trading day due to the steady resistance at $63.70, which put it under negative pressure from the EMA50. With the emergence of negative signals on (RSI), after reaching the overbought level, it surpassed the bullish correction trend line on a short-term basis and announced an expansion of losses on a near-term basis.

4. Institutional View

Citi: Upgrading Oracle (ORCL.N) rating to buy target price to $410

Citi published a research report, upgrading Oracle (ORCL.N) rating from neutral to buy. Therefore, the record-breaking order performance in the first quarter has enhanced the bank's confidence in the durability and profitability of its AI business. Its orders of more than $330 billion in the first quarter were stunning, accompanied by a sharp increase in Infrastructure-as-a-service (IaaS) revenue (growing sixfold to $114 billion over the next three years, up from the bank’s estimate of $87 billion). Citi continues to point out that concerns about Oracle's profitability have also been better addressed, with the www.xmhouses.company guiding EBIT growth in fiscal 2026 to medium-ten-digits, higher than the bank's estimate of 6%. Based on the bank's positive view of AI infrastructure demand, Citi believes that Oracle's stock price still has room for upward, and the growth of revenue and net profit will accelerate significantly in the next few years, further establishing Oracle's position as a unique large-scale AI winner. Citi said it significantly raised its forecasts after stunning order numbers and far exceeding expectations, especially IaaS, total revenue and earnings per share in fiscal 2028, respectively. Monitoring the short-term demand for AI infrastructure and significant growth in RPO, the target multiple increased to 37 times. Therefore, the target price is raised from $240 to $410; the target price is based on a 37-fold price-to-earnings ratio of $11.11 per share in fiscal 2028.

The above content is all about "[XM official website]: The ECB keeps interest rates unchanged, and the short-term trend analysis of spot gold, silver, crude oil and foreign exchange on September 11" was carefully www.xmhouses.compiled and edited by the editor of XM Forex. I hope it will be helpful to your trading! Thanks for the support!

Only the strong know how to fight; the weak are not qualified to fail, but are born to be conquered. Step up to learn the next article!

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here