Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- Tariff threats to remove expectations hit the dollar hard, pound welcomes PMI da

- Jackson Hall Central Bank Annual Meeting is Coming, New Zealand Fed Resolution a

- The Fed's expectation of a rate cut is shaken, how will the US dollar perform in

- The US dollar index is approaching its previous high, and the three major moment

- Gold, more than 3370!

market news

The market assesses the impact of U.S. sanctions on Russian oil, trade tensions ease, and gold prices hit their first weekly decline in 10 weeks

Wonderful introduction:

A secluded path, with its twists and turns, will always arouse a refreshing yearning; a huge wave will make a thrilling sound when the tide rises and falls; a story, regretful and sad, only has the desolation of the heart; a life, with ups and downs, becomes shockingly heroic.

Hello everyone, today XM Forex will bring you "[XM Foreign Exchange Market www.xmhouses.commentary]: The market assesses the impact of US sanctions on Russian oil, trade tensions ease, and gold prices hit their first weekly decline in 10 weeks." Hope this helps you! The original content is as follows:

Basic news

On Monday (October 27, Beijing time), spot gold was trading around US$4,083 per ounce. The price of gold hit a weekly decline last week for the first time in 10 weeks. After falling, investors took profits and signs of easing trade tensions suppressed safe-haven demand; U.S. crude oil traded around $62 per barrel. Due to U.S. sanctions on Russia, India's imports of Russian crude oil decreased, while trade tensions eased, boosting demand.

Focus during the day

Profit data of China's industrial enterprises above designated size in September, Germany's IFO business climate index in October, and the UK's CBI retail sales difference in October.

Stock Market

The three major U.S. stock indexes closed at record highs last Friday, as U.S. inflation data was lower than expected and corporate earnings reports were outstanding, paving the way for this week's earnings announcement and the Federal Reserve's expected interest rate cut. The S&P 500 and Nasdaq had their biggest weekly gains since August, and the blue-chip Dow Jones Industrial Average had its biggest weekly gains since June.

The September consumer price index released by the U.S. Department of Labor remained high, but slightly lower than analysts’ expectations. This calmed concerns about the excessive impact of tariffs on inflation and almost confirmed that the Federal Reserve will cut interest rates by 25 basis points at the end of next week’s monetary policy meeting.

With the budget impasse in Congress leading to a government shutdown and official data releases generally stalled, the CPI report has become a rare economic indicator.

CarsonGroup chief market strategist Ryan Detrick said: "We areThere was some good news on the inflation front, with dovish CPI data opening the door for the Fed to cut interest rates next week or even in December. "

According to data from London Stock Exchange Group (LSEG), 143 www.xmhouses.companies in the S&P 500 Index have announced third-quarter earnings.

Currently, analysts expect S&P 500 third-quarter earnings to increase by 10.4% year-on-year. www.xmhouses.compared with LSEG's earnings as of October 1 This marks a significant improvement www.xmhouses.compared to the 8.8% annual growth forecast.

Detrick added: "This earnings season has started off very well, with 87% of www.xmhouses.companies reporting earnings exceeding expectations and 83% reporting revenue exceeding expectations. This not only supports the stock market rally this year, but also may pave the way for a strong rebound at the end of the year." "

Many heavyweight www.xmhouses.companies will announce their financial reports this week. The financial reports of MetaPlatforms, Microsoft, Alphabet, Amazon and Apple are attracting attention. They are the five large-cap momentum stocks among the "Big Seven". In addition, industrial stocks Stocks such as Caterpillar and Boeing will also become the focus of market attention.

The Dow Jones Industrial Average rose 1.01% to 47207.12 points; the S&P 500 Index rose 0.79% to 6791.69 points; the Nasdaq Index rose 1.15% to 47207.12 points. 23204.87 points.

Alphabet's stock price rose 2.7% after Anthropic expanded its cooperation agreement with Google and plans to use up to one million Google artificial intelligence chips to train its Claude chatbot.

Coinbase Global surged 9.8% after JPMorgan upgraded its stock rating from "neutral" to "overweight."

DeckersOutdoor forecasts full-year sales to be lower than Wall Street Street expectations caused the Hoka sneaker maker's stock price to plummet 15.2%. Ford Motor's third-quarter profit exceeded expectations, and its stock price rose 12.2%. General Dynamics also beat expectations, sending its shares up 2.7%. Alaska Airlines fell 6.1% after the airline lowered its annual forecast.

Gold Market

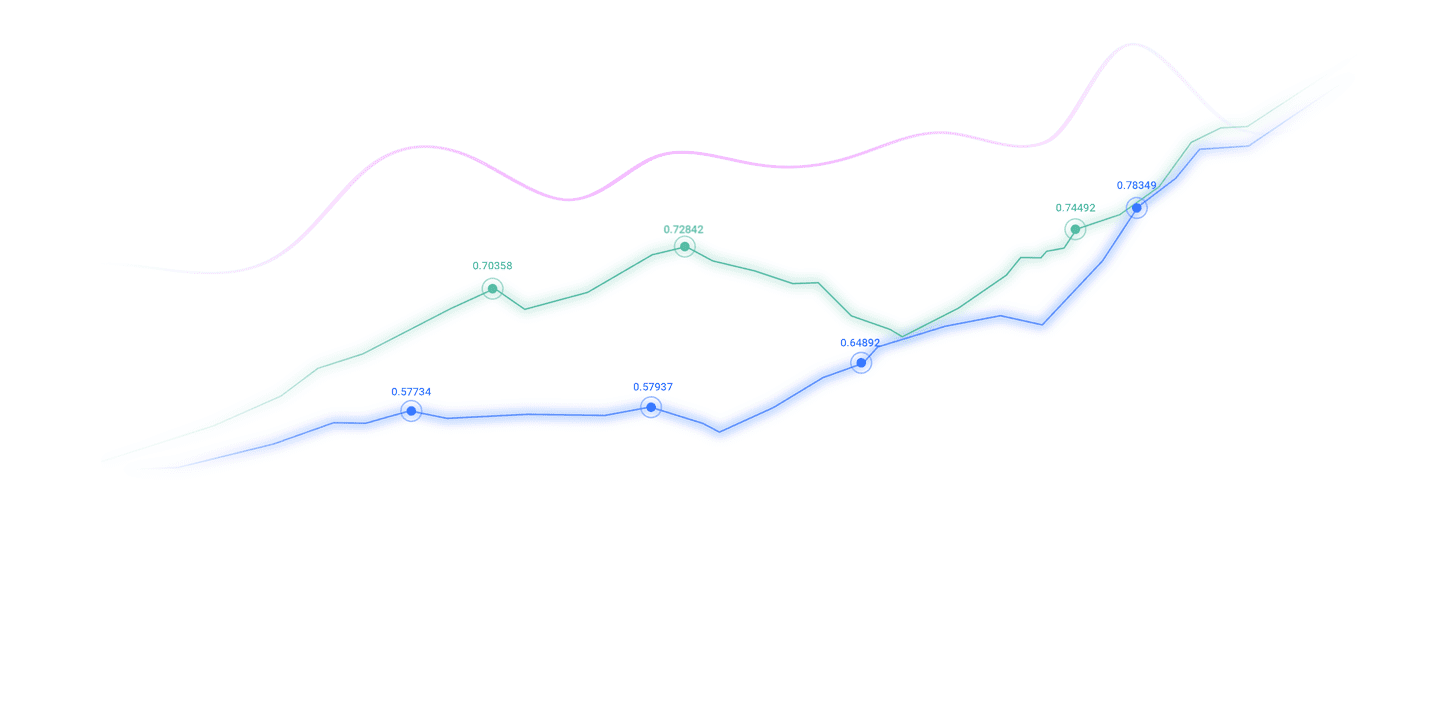

Gold prices narrowed losses on Friday but posted their first weekly decline in 10 weeks after the U.S. released inflation data that was slightly lower than expected, reinforcing expectations of a rate cut by the Federal Reserve.

Spot gold fell 0.2%, It was quoted at US$4,118.29 per ounce, falling nearly 2% at the beginning of the session. Gold prices fell more than 3% last week. U.S. gold futures for December delivery closed 0.2% lower at $4,137.8 an ounce.

Independent metals trader TaiWong said gold and silver recovered as core CPI fell below expectations in September, but this may not be enough to www.xmhouses.completely curb last week's decline. Price action suggests that gold, and especially silver, need to move lower for a while before consolidating.

Spot gold hit a record high of $4,381.21 on Monday, but has since fallen more than 6% as investors took profits and signs of easing trade tensions curbed safe-haven demand.

Spot silver was at $48.65 per ounce, down 0.6%, a weekly decline of more than 6%. U.S. Labor Department data showed that U.S. consumer prices rose 3.0% in the 12 months through September, slightly lower than economists' expectations of 3.1%.

Traders expect the Fed to almost certainly cut interest rates at this week’s meeting, with another rate cut expected in December. Interest rate cuts will reduce the opportunity cost of holding non-interest-bearing assets such as gold.

Affected by factors such as geopolitical and trade tensions, strong central bank buying and expectations of U.S. interest rate cuts, gold prices have risen by 55% since the beginning of this year.

Among other precious metals, platinum fell 1% to $1,608.77; palladium fell 0.5% to $1,450.05.

Oil Market

Oil prices fell on Friday as the market began to doubt whether the Trump administration would strictly enforce sanctions on Russia's two major oil www.xmhouses.companies. Brent crude oil futures closed down 0.1% at $65.94 a barrel; U.S. crude oil futures fell 0.5% to close at $61.50 a barrel.

Both major crude oil benchmarks rose in early trading, extending gains of more than 5% after the sanctions were announced last Thursday, but fell back in the last two hours of trading. The two major benchmarks of crude oil still rose by more than 7% last week, the largest weekly gain since mid-June.

AgainCapitalLLC partner John Kilduff said: "People are once again doubting whether these sanctions will be as severe as stated."

U.S. President Trump imposed sanctions on Rosneft and Lukoil to pressure Russian President Vladimir Putin to end the war in Ukraine.

The two www.xmhouses.companies together account for more than 5% of global oil production. In 2024, Russia is the world's second-largest crude oil producer after the United States. Industry insiders said that Indian refineries, as the largest buyers of Russian seaborne crude oil, will significantly reduce Russian crude oil imports.

Janiv Shah, vice president of oil market analysis at Rystad Energy, said in a report to clients: Crude oil flowing to India is particularly at risk.

Kuwait’s oil minister said the Organization of the Petroleum Exporting Countries (OPEC) will be ready to make up for any shortfall in the market by increasing production.

Foreign Markets

The dollar was almost flat on Friday after new inflation data showed U.S. consumer prices rose less than expected in September, keeping the Federal Reserve still on track to cut interest rates again this week.

The U.S. Consumer Price Index (CPI) increased by 0.3% month-on-month and 3.0% year-on-year in September. Economists polled by Reuters expected the consumer price index to rise 0.4% last month and 3.1% year-on-year. The U.S. dollar index fell 0.021% in late New York trading to 98.934points, which had previously fallen as much as 0.2%, but still rose slightly last week.

Marc Chandler, chief market strategist at Bannockburn Capital Markets, said: The overall CPI was weaker than expected, and the dollar was sold off in response, even though before the report was released, the market was almost 100% convinced that the Federal Reserve would cut interest rates not only this week, but also in December. Despite the lack of economic data due to the government shutdown, the CPI report was released. The data, used by the Social Security Administration to calculate cost-of-living adjustments for millions of retirees and other welfare recipients, was supposed to be released on Oct. 15.

EUR/USD was trading at $1.163 in late New York trading, an increase of 0.06%. A survey on Friday showed that business activity in the euro zone grew faster than expected in October, led by the euro zone's services sector.

An advertisement released in Ontario, Canada, quoted a recording of former U.S. President Ronald Reagan criticizing tariffs. As a result, U.S. President Trump announced the termination of all trade negotiations with Canada, making concerns about trade wars once again the focus of the agenda. The Canadian dollar was slightly lower at C$1.40 against the U.S. dollar in late trading, but the overall market reaction was quite muted.

New U.S. sanctions on two major Russian oil www.xmhouses.companies over Russia's war in Ukraine pushed up oil prices. That weighed on currencies linked to oil imports, including the yen. The fate of the yen is also closely related to the policies of Japan's new Prime Minister Sanae Takaichi. The outside world generally believes that the high market is a fiscal and monetary dovish person.

The yen/dollar weakened to a two-week low, last trading at 152.85 yen. Data released last Friday showed that Japan's national core consumer price index (CPI) rose 2.9% year-on-year in September, higher than the Bank of Japan's 2% inflation target, keeping the market's expectations of a recent interest rate hike.

Takako is preparing an economic stimulus package that could exceed last year's $92 billion to help Japanese households cope with inflation, government sources familiar with the plan said last Wednesday.

The pound fell 0.15% against the dollar to $1.33 after UK retail sales data were stronger than expected. Sterling fell about 1% last week after weak inflation data increased investor expectations for a rate cut by the Bank of England this year.

International News

Trump said that the United States will impose an additional 10% tariff on Canadian goods

U.S. President Trump posted on the social media platform TruthSocial that Canada was caught red-handed and tampered with Ronald? Deceptive advertising of Reagan's tariff speech. The Reagan Foundation stated that Canada "selected some audio and video clips of President Ronald Reagan to create an advertising campaign that distorted the original meaning of the President's radio speech" and "neither asked for permission nor obtained authorization before using and editing these remarks. In view of Canada's serious distortion of facts and hostile behavior, it has decided to pay Canada's current tariffsOn the basis of the amount, an additional 10% tariff will be levied on it.

Trump overturns regulations on copper smelters during the Biden administration

US President Donald? Trump reversed an air pollution rule from the Biden administration that had imposed tighter limits on emissions from copper smelters. The "New Copper Smelter Regulations" will be officially finalized in May 2024, requiring copper smelters to control emissions of pollutants such as lead, arsenic, mercury, benzene and dioxins based on updated federal air quality standards. Trump's proclamation provides a two-year exemption from www.xmhouses.compliance for affected stationary sources of pollution, specifically copper smelters. The White House said the move would help improve U.S. mineral security by reducing the regulatory burden on domestic copper producers. In announcing the adjustment, the White House said: "Implementing such requirements on this limited and already stressed domestic industry could accelerate more factory closures, weaken the nation's industrial base, undermine the ability to independently supply minerals, and increase reliance on foreign-controlled processing capacity."

Major European rating agencies downgraded the U.S. sovereign credit rating

European credit rating agency Scope Ratings recently issued a report, downgrading the U.S. sovereign credit rating from "AA" to "AA-" due to the continued deterioration of the U.S. public finances and the decline in government governance standards. The agency said that the continued deterioration of U.S. public finances is mainly reflected in the continued high fiscal deficit, rising interest payments and limited budget flexibility. Together, these factors have driven government debt levels to continue to rise. The report predicts that in the absence of substantive reforms, the ratio of U.S. government debt to gross domestic product (GDP) will rise to 140% by 2030, much higher than that of most sovereign countries. The report pointed out that the decline in government governance standards was also an important reason for the rating downgrade. The agency believes that the US executive power is increasingly concentrated, and the Trump administration has repeatedly ignored court orders, challenged judicial authority, and circumvented congressional supervision, reducing the predictability and stability of policy formulation and increasing the risk of policy errors. The uncertainty shown by the United States in tariff negotiations with its major trading partners is an example of this. The agency also said that the U.S. rating outlook is "stable" and the risks of rating upgrades and downgrades in the next 12 to 18 months are generally balanced. The report emphasizes that downside risks include a continued rise in debt levels and a possible significant weakening of the U.S. dollar's status as the global reserve currency, resulting in lower global demand for U.S. Treasury bonds. Scope Ratings, headquartered in Berlin, Germany, became the first European credit rating agency recognized by the European Central Bank in 2023. There are two levels above "AA" in the agency's credit rating system.

U.S. Congressman: The U.S. government shutdown may last until the end of November

U.S. Republican Representative Anna Paulina Luna said that the U.S. government “shutdown” may last until the end of November. "I'm hearing that we may not be able to get back to normal operations until Thanksgiving or even later," Luna said in an interview with Fox News. Thanksgiving in the United States will be on November 27 this year.

The "shutdown" of the U.S. government has caused a shortage of air traffic control personnel and delayed thousands of flights

On the 26th local time, U.S. Transportation Secretary Sean Duffy said that on the 25th, airports across the United States reported more than 20 air traffic control personnel shortages. According to data from flight tracking websites, more than 5,300 flights were delayed in the United States on the 25th; as of 16:00 on the 26th, more than 4,700 flights had been delayed. Since the "shutdown" of the U.S. government, air traffic control, which is already short of manpower, has become even more stretched, and flights have been delayed at many airports in the United States. The government warned that as air traffic control personnel will not receive wages at all for the first time on the 28th, the shortage of air traffic control personnel will further intensify in the next few days, leading to more flight delays and cancellations.

As the government "shutdown" continues, food assistance for low-income people in the United States will stop on November 1

According to CCTV News, on October 25, local time, the U.S. Department of Agriculture issued a notice on its website stating that the U.S. federal government's "Supplemental Nutrition Assistance Program" will cease on November 1. Funding has dried up, the USDA said. Currently, no benefits will be distributed on November 1st. It is reported that the U.S. federal government's "Supplemental Nutrition Assistance Program" covers about 42 million people, with the main beneficiaries being low-income groups, disabled people and the elderly. These groups can use government-subsidized food stamps to buy food at designated stores.

California Governor Newsom admitted: considering running for the 2028 presidential election

California Governor Newsom said that if he denied that he was considering running for president, he would be "lying." When asked if he would "seriously consider" running for president after the midterm elections (2026), the governor agreed. Newsom has become one of the leading voices opposing President Donald Trump, harshly criticizing his administration's handling of issues such as the deployment of the National Guard and the arrest of immigrants. Due to term limits, he will not be able to run for re-election as governor in 2026. Newsom has previously said he would need a "why" if he decided to run for president. Newsom said that if a person has a "compelling reason," then one can persevere no matter "how difficult the process is." He said: "I think the biggest challenge for anyone running for public office is that people can see through you at a glance. If you don't have that 'why', then you are running for the wrong reasons."

U.S. Treasury Secretary: The U.S. military may stop paying salaries before November 15 due to the government shutdown

U.S. Treasury Secretary Scott Bessant said that if the government shutdown continues, the U.S. military may stop paying salaries before November 15. U.S. Republican Representative Anna Paulina Luna said that the U.S. government "shutdown" may last until the end of November. "I think we will be able to pay them in early November, but by November 15th, the soldiers and military personnel who are risking their lives will not be able to get their pay," Bessant said in an interview with CBS. White House economic adviser Hassett said on October 5 that if the U.S. government shuts downIf it continues, it could result in a weekly loss of about $15 billion in U.S. gross domestic product.

Domestic News

Cui Dongshu, a branch of the China Passenger Car Alliance: The national passenger car industry had 3.28 million vehicles in stock at the end of September, with the inventory falling from 39 days to 6 days www.xmhouses.compared with the same period last year

On October 25, China Passenger Car Alliance Cui Dongshu, secretary-general of the branch, issued a document stating that at the end of September 2025, the national passenger car industry had 3.28 million vehicles in stock, an increase of 120,000 vehicles from the previous month and an increase of 260,000 vehicles from September 2024, forming the peak season stocking characteristics of inventory recovery. In April 2025, the industry inventory of 3.5 million vehicles hit a new high in the past two years. The auto market retail sales driven by trade-in are relatively high, but manufacturers are relatively cautious in production. From May to August, auto www.xmhouses.companies are relatively more rational in controlling production, reducing inventory pressure on dealers, resulting in continuous destocking from May to August, and inventory recovery in September 2025. Among them, manufacturer inventory accounted for 24.6%, an increase of 0.7 percentage points from the previous month. The forecast team of the China Passenger Car Association predicts that the total sales volume of manufacturers will be very strong in the next few months. The www.xmhouses.comprehensive estimate of inventory and future sales at the end of September 2025 will support the number of future sales days at 39 days. www.xmhouses.compared with 50 days in September 2023 and 45 days in September 2024, the overall inventory pressure in September this year has dropped significantly.

Li Chenggang: China and the United States have reached a preliminary consensus on the prudent settlement of a number of important economic and trade issues

From October 25 to 26, local time, China and the United States held economic and trade consultations in Kuala Lumpur. Li Chenggang, international trade negotiator and deputy minister of the Chinese Ministry of www.xmhouses.commerce, told Chinese and foreign media reporters after the consultation that the two sides had reached a preliminary consensus on properly resolving a number of important economic and trade issues of mutual concern, and the next step would be to implement their respective domestic approval procedures. "In the past month or so, there have been some shocks and fluctuations in Sino-US economic and trade relations, and the world has paid close attention to them." Li Chenggang said that since the Sino-US economic and trade talks in Geneva in May this year, China has strictly followed the consensus reached by the heads of state of China and the United States on multiple phone calls, faithfully and conscientiously implemented the consensus arrangements reached in the economic and trade consultations, and carefully protected the hard-won and relatively stable Sino-US economic and trade cooperation relations. "These shocks and fluctuations are not what China wants to see." "The United States is tough in expressing its position, and China is firm in safeguarding its interests." Li Chenggang said that during this consultation, the Chinese and American economic and trade teams always respected each other and talked on an equal footing. In the future, the two sides will further strengthen www.xmhouses.communication and exchanges and make active efforts for a more stable and healthy development of Sino-US economic and trade relations.

The above content is all about "[XM Foreign Exchange Market www.xmhouses.commentary]: The market assesses the impact of U.S. sanctions on Russian oil, trade tensions ease, and gold prices hit their first weekly decline in 10 weeks." It is carefully www.xmhouses.compiled and edited by the XM foreign exchange editor. I hope it will be helpful to your trading! Thanks for the support!

Due to the author's limited ability and time constraints, some contents in the article still need to be discussed and studied in depth. Therefore, in the future, the author will conduct extended research and discussion on the following issues:

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here