Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- Eagle and bear share Ukraine, with gold and silver empty after the Yin and Yang

- The US dollar index has been falling continuously, and competition for the posit

- Oil prices fall to more than two months lows, Fed's easing bets boost gold price

- The US dollar index soared in the past two days, and the market price approached

- Gold has broken through dawn and space is expected!

market news

Super central bank week, the Federal Reserve and Canada are expected to cut interest rates, and the European/Japanese central banks may stay on hold

Wonderful introduction:

Out of the thorns, in front of you is a broad road covered with flowers; when you climb to the top of the mountain, you will see the green mountains at your feet. In this world, if one star falls, it cannot dim the starry sky; if one flower withers, it cannot make the entire spring barren.

Hello everyone, today XM Forex will bring you "[XM Forex Platform]: Super Central Bank Week, the Federal Reserve and Canada are expected to cut interest rates, and the European and Japanese central banks may stay on hold". Hope this helps you! The original content is as follows:

XM Foreign Exchange Market Preview: The economic data to be released this week from high to low importance are: the Federal Reserve interest rate decision, the European Central Bank interest rate decision, the Bank of Japan interest rate decision, the Bank of Canada interest rate decision. Next, we will interpret them one by one.

▲XM Chart

At 2:00 this Thursday, the Federal Reserve will announce the results of the October interest rate resolution, and at 2:30, Federal Reserve Chairman Powell will hold a monetary policy press conference. This week's interest rate decision is the Fed's seventh meeting this year and its penultimate meeting. The outcome of the meeting will profoundly affect the trends of gold, silver, and the U.S. dollar. Mainstream expectations are that the Federal Reserve will announce a 25 basis point interest rate cut at this interest rate resolution. According to CME data, the probability of the Fed cutting interest rates has reached more than 99%, which can be said to be a certainty. What needs to be reminded is that the more consistent market expectations are, the more likely the market will fluctuate in the opposite direction. The Federal Reserve cut interest rates by 25 basis points, which means that the Federal Reserve has officially entered the interest rate cutting channel, and the U.S. dollar's interest rate advantage has been weakened. Logically, the U.S. dollar index will fall sharply after the resolution is announced. However, considering the issue of "buy expectations, sell facts", the short-term trend of the US dollar index is very likely to rebound abnormally after the resolution results are announced. The press conference of Federal Reserve Chairman Powell is also the focus of market attention. If Powell expresses an overly pessimistic view on the U.S. job market or mentions too much the impact of tariffs on inflation, the dollar index may suffer a second blow.

▲XM Chart

At 21:15 this Thursday, the European Central Bank will announce the results of the October interest rate decision. At 21:45, ECB President Lagarde will hold a monetary policy press conference. The market expects that the ECB will make this interest rate decision. The European Central Bank has kept its three key interest rates unchanged for two consecutive times since the last rate cut in June. ECB President Lagarde said this month, "As far as where we are now, we are in a good position to be able to cope with future shocks." "This speech implies that the ECB has no intention to adjust the current key interest rate. Failure to adjust the interest rate does not mean that the outcome of the resolution will not impact the trend of the euro. Lagarde's speech at the press conference can directly affect market participants' confidence in the euro. In the past six months, due to Trump's series of radical policies, the U.S. dollar index has continued to fall, and the euro has gained momentum for reverse appreciation. If The macroeconomic development of the euro area cannot match the appreciation trend of the euro, and the EURUSD may turn around and fall. Currently, the euro area is facing issues such as high public debt, Ukraine issues, and high tariffs in the United States. If Lagarde mentions these sensitive topics at the press conference, the EURUSD will fluctuate violently, and risk prevention is required.

▲XM Chart

During the Asian session this Thursday, the Bank of Japan will announce the results of the October interest rate decision. At 14:30, Bank of Japan Governor Kazuo Ueda will hold a press conference. Although mainstream expectations are that the Bank of Japan will keep its benchmark interest rate unchanged at 0.5% at this interest rate decision, market participants are clamoring for the Bank of Japan to raise interest rates again. According to a Reuters survey of economists, 14% of economists believe the Bank of Japan will raise interest rates at the October resolution, and 31% believe that the Bank of Japan will raise interest rates at the December resolution. Bank of Japan review member Naoki Tamura said this month that given the risk of rising prices, the Bank of Japan should push interest rates closer to neutral levels to avoid being forced to raise interest rates significantly in the future. Therefore, although the probability of the Bank of Japan announcing a 25 basis point interest rate hike this time is low, the risk cannot be ignored. Japan's core CPI annual rate in September was 2.9%, higher than the previous value of 2.7% and in line with expectations. The inflation rate of 2.9% has clearly exceeded the central bank's regulatory target of 2%. If the Bank of Japan does not raise interest rates as soon as possible, it may face the risk of out-of-control inflation in the future.

▲XM Chart

At 21:45 this Wednesday, the Bank of Canada will announce the results of its October interest rate resolution. Mainstream expectations are that it will cut interest rates by 25 basis points. Canada's economic development relies heavily on the United States. Since the beginning of this year, U.S. President Trump has continued to increase tariffs on imported goods from Canada, www.xmhouses.compounding the macroeconomic recession in the United States itself.There are signs that the growth prospects of the Canadian economy are extremely pessimistic. Last Saturday, Trump stated on social media that he would impose an additional 10% tariff on Canada in retaliation for its advertisements criticizing U.S. tariff policies. This will seriously weaken the confidence of market participants in holding the Canadian dollar.

▲XM Chart

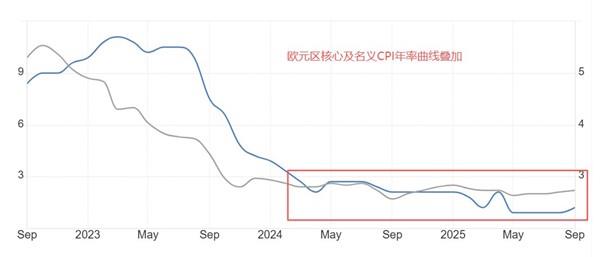

At 18:00 this Friday, Eurostat will announce the initial value of the annual core CPI rate in the Eurozone in October. The expected value is 2.3%, lower than the previous value of 2.4%. The initial annual CPI value for the Eurozone in October was also announced, with market expectations of 2.1%, lower than the previous value of 2.2%. In absolute terms, an inflation rate above 2% is in line with the European Central Bank's goal of moderate inflation. Judging from historical data, both the core and nominal CPI annual rates in the Eurozone have entered a stable period, and there are no longer extreme situations of sharp rises and falls. The stability of the inflation rate is an important reason for the European Central Bank's decision to suspend interest rate cuts.

XM risk warning, disclaimer, special statement: The market is risky, so investment needs to be cautious. The above content only represents the personal views of analysts and does not constitute any operational advice. Please do not rely on this report as your sole reference. Analysts' views may change at different times and will be updated without notice.

The above content is all about "[XM Foreign Exchange Platform]: Super Central Bank Week, the Federal Reserve and Canada are expected to cut interest rates, and the European/Japanese central banks may stay on hold". It is carefully www.xmhouses.compiled and edited by the editor of XM Foreign Exchange. I hope it will be helpful to your trading! Thanks for the support!

After doing something, there will always be experiences and lessons learned. In order to facilitate future work, the experience and lessons of past work must be analyzed, researched, summarized, concentrated, and understood at a theoretical level.

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here