Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- The dollar "return of the king" waits for Powell Jackson Hall to speak

- Why did Powell suddenly let go as the US dollar index rebounded?

- The weakness of non-US currencies resonates with short-selling rebound. Can the

- Gold is still in a volatile downward adjustment, pay attention to 3360-3300

- Copper prices fluctuate at high levels waiting for macro guidance, Chile's expec

market news

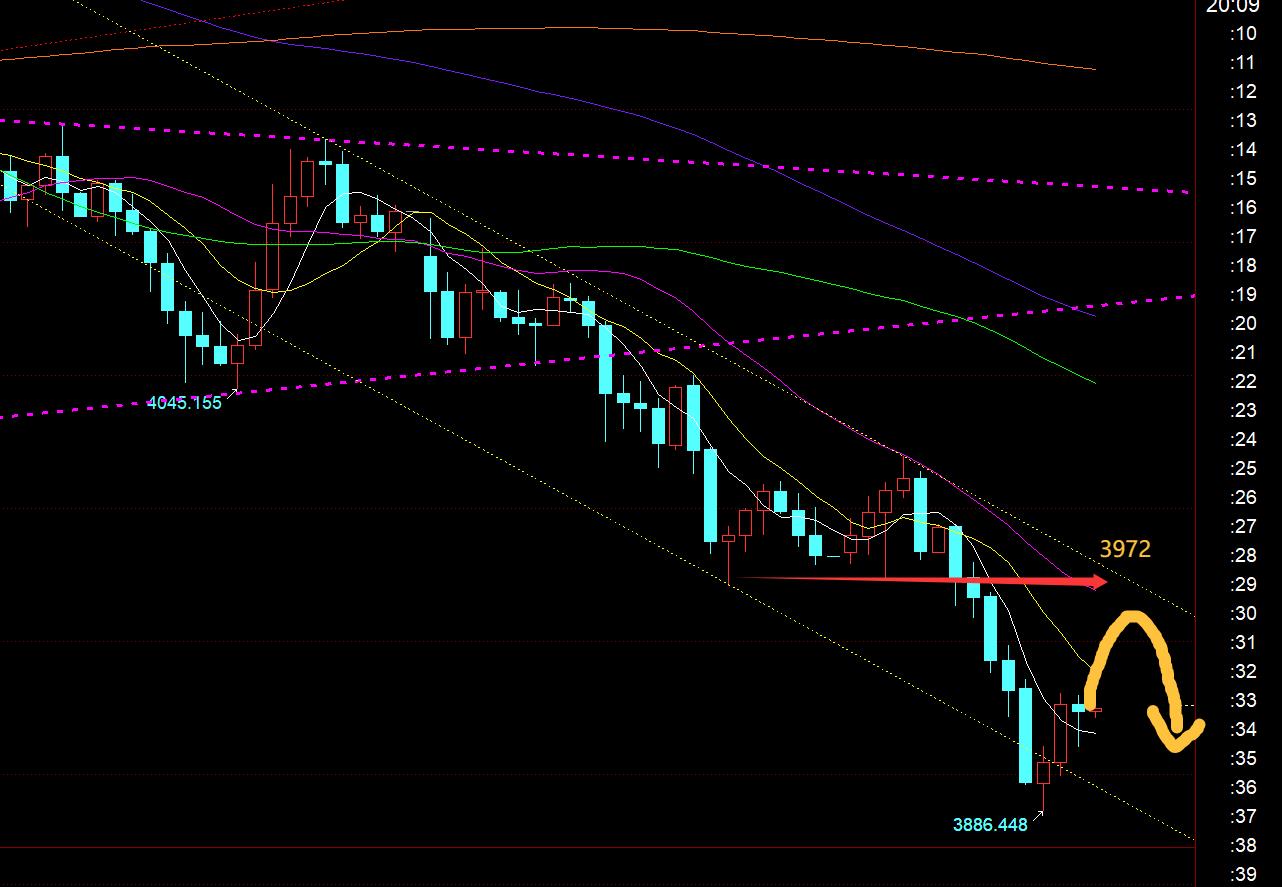

Gold continues to fall, with Feng Shui Ridge moving down 3972 today

Wonderful introduction:

The moon waxes and wanes, people have joys and sorrows, life changes, and the year has four seasons. If you survive the long night, you can see the dawn, if you endure the pain, you can have happiness, if you endure the cold winter, you no longer need to hibernate, and after the cold plums have fallen, you can look forward to the new year.

Hello everyone, today XM Forex will bring you "[XM Foreign Exchange Decision Analysis]: Gold continues to fall, and the Feng Shui Ridge moved down by 3972 today." Hope this helps you! The original content is as follows:

Zheng's Point Silver: Gold continues to fall, and the Feng Shui Ridge moved down by 3972 today

Reviewing yesterday's market trends and emerging technical points:

First, gold: yesterday afternoon it touched the bottom of last week and the convergence triangle lower track support 4055 was bullish, 4075 meters were closed, and the highest was 4085, but it still could not break through the hourly mid-track 4090, and the European market opened. After a wave of pressure, the bottom triangular lower track support is effectively lost, and there may be a second downward trend in the evening. Relying on the channel's counter-pressure point of 4060, we can continue to fall back, but unfortunately it only reaches 4050; in the evening, it reaches 3972, and a bottom pull occurs. The sign of stabilization is also the 382 split position of the backtest since the unilateral increase of 3311. Then 3980 steps back to see a rebound, 3993-92 is also bullish in advance, 4007 takes the closing meter, and 3980 happens to be It hit the low point in the middle of the night, and then rose sharply this morning, finally reaching the expected 4020;

Second, silver: Yesterday afternoon, it also relied on the support of the lower track of last week's bottom consolidation range to stabilize, 48 Following the bullish rebound, the meter closed at 48.3, but it also failed to break through the hourly mid-range track of 48.5. Finally, the European market broke through and went down. Before the US market, it relied on the counter-pressure point of 47.9 to try a second bearish pullback, but unfortunately it did not give the opportunity. Yes, the highest is 47.8, and the lowest is 46 at night;

Today's market analysis and interpretation:

First, the daily gold level: Yesterday it closed in the negative, and it lost the support of the mid-rail. What I originally expected today was to close a cross or a small yang or a small yin, and then rebound to confirm the resistance of the mid-rail and then rush higher and fall back to prepare for a wave of rise after tomorrow's interest rate cut. It can also easily cause a dive after the mid-rail breaks, tempting investors to followThe wind continues to be bearish at low levels; in fact, it continued to fall today, falling below the two support levels of 3945 and 3914, which is stronger than originally deduced. This will indeed delay the rise from the second high point in the later period, so we can only wait patiently; then after the 3914 position is lost, pay attention to the three positions of the lower support. One is 3870, which belongs to the 4-hour annual moving average, the other is 3846, which belongs to 3311 rising to 4381 and stepping back to the 50 division position, and the other is 3825, which is the weekly 10 moving average. Let’s see if the short-term bottom can appear at one of these three positions;

Second, the golden hour line level: at 9 o'clock this morning, it was a good day to bottom out and pull up the Yang K. I thought I could break through the middle rail to confirm the resistance of the next daily 5-day moving average and then rush higher and fall back. The result was that I still couldn't cross the middle rail. I will continue to pay attention to its gains and losses tonight. It is also a Fengshui ridge, that is, 3972, which is also a top and bottom; as long as it cannot break above it, then it is still possible in the short term. It is to maintain the weak operation below; because the European market has broken the bottom, the rebound tonight can still wait for the second bearish pullback. For reference resistance, the latest is 3938 on the 10th, which is also divided by 382 on the 10th, followed by 3950 and strong pressure of 3972. The highs suppress the bearish decline, and the support range of 3890-3870 should be paid attention to first; because silver performs better than gold today, and it The strength of the rally before the U.S. market is OK, and it is testing the middle track. Once silver breaks through the middle track, it will gradually stabilize in the short term in advance, and gold will follow suit. Therefore, try to wait for the second bearish position tonight at 3972-3950. You would rather miss it, but you must always be cautious. The opportunity to rebound at the low level must wait until the second decline is over, similar to the situation last night. You can test after reaching the bottom and stabilizing K; or you can break through the feng shui ridge, that is, stand on the middle track, and step back to follow. This probability is very small; the key point is to wait for a heavy blow after tomorrow's interest rate cut. This time, the decline in selling facts has basically been released in advance, so after the interest rate cut is announced, there is a high probability that the decline in selling facts will be much weaker, or even not occur;

Silver: Silver has been suppressed and corrected to the weekly 10 moving average of 45.6 in one breath. The hourly MACD has shown a clear bottom divergence, and there is also a relatively good continuous positive pattern before the US market. It is testing the upper rail resistance of 46.6 on the downward channel, which is also the middle rail of the hourly line; for it, I personally think that the short-term bottom is gradually www.xmhouses.coming out, and there is basically not much room below, and it can be reached at any time. It may stabilize in advance; focus on 46.6. Once it breaks above, a short-term reversal signal will appear, and the bullish rebound will follow, testing 47.2, 48, etc. above; if 46.6 is still suppressed from falling, pay attention to the stabilization signals on 45.9 and 45.6. It is also possible to wait for the second round of divergence before making an oversold rebound; in fact, this divergence has already been broken after 47.4 fell below.It is a back-in-back situation. It is very serious and urgently needs an oversold rebound;

The above are several views of the author's technical analysis. As a reference, it is also a summary of the technical experience accumulated from watching and reviewing the market for more than 12 hours a day for more than 12 hours a day. The technical points will be disclosed every day with text and video interpretation. Friends who want to learn can www.xmhouses.compare and reference based on the actual trend; those who agree with the idea can refer to the operation, take good defense, and risk control first; no If you approve it, just pass it by; thank you all for your support and attention;

[The opinions in the article are for reference only, investment is risky, you need to be cautious when entering the market, operate rationally, strictly set losses, control positions, risk control first, and be responsible for profits and losses]

Writer: Zheng Shi Dian Yin

Reading and researching the market more than 12 hours a day for ten years. Detailed technical interpretations are made public on the entire network, and we serve with sincerity, dedication, sincerity, perseverance and wholeheartedness to the end! Write www.xmhouses.comments on major financial websites! Proficient in K-line rules, channel rules, time rules, moving average rules, segmentation rules, and top-bottom rules; student cooperation registration hotline - WeChat: zdf289984986

The above content is about "[XM Foreign Exchange Decision Analysis]: Gold continues to fall, and the Feng Shui Ridge moved down by 3972 today". It is carefully www.xmhouses.compiled and edited by the XM Foreign Exchange editor. I hope it will be helpful to your trading! Thanks for the support!

Only the strong know how to fight; the weak are not even qualified to fail, but are born to be conquered. Hurry up and study the next content!

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here