Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- 【XM Forex】--USD/CHF Forex Signal: Eyes Breakout at 0.92

- 【XM Market Analysis】--NASDAQ 100 Forecast: Index Runs into Ceiling on Thursday

- 【XM Market Review】--GBP/USD Forex Signal: Rebounds, But Downtrend Still Intact

- 【XM Group】--ETH/USD Forecast: Bounces Back from Major Selloff

- 【XM Market Analysis】--WTI Crude Oil Forecast: Tests Key Range

market analysis

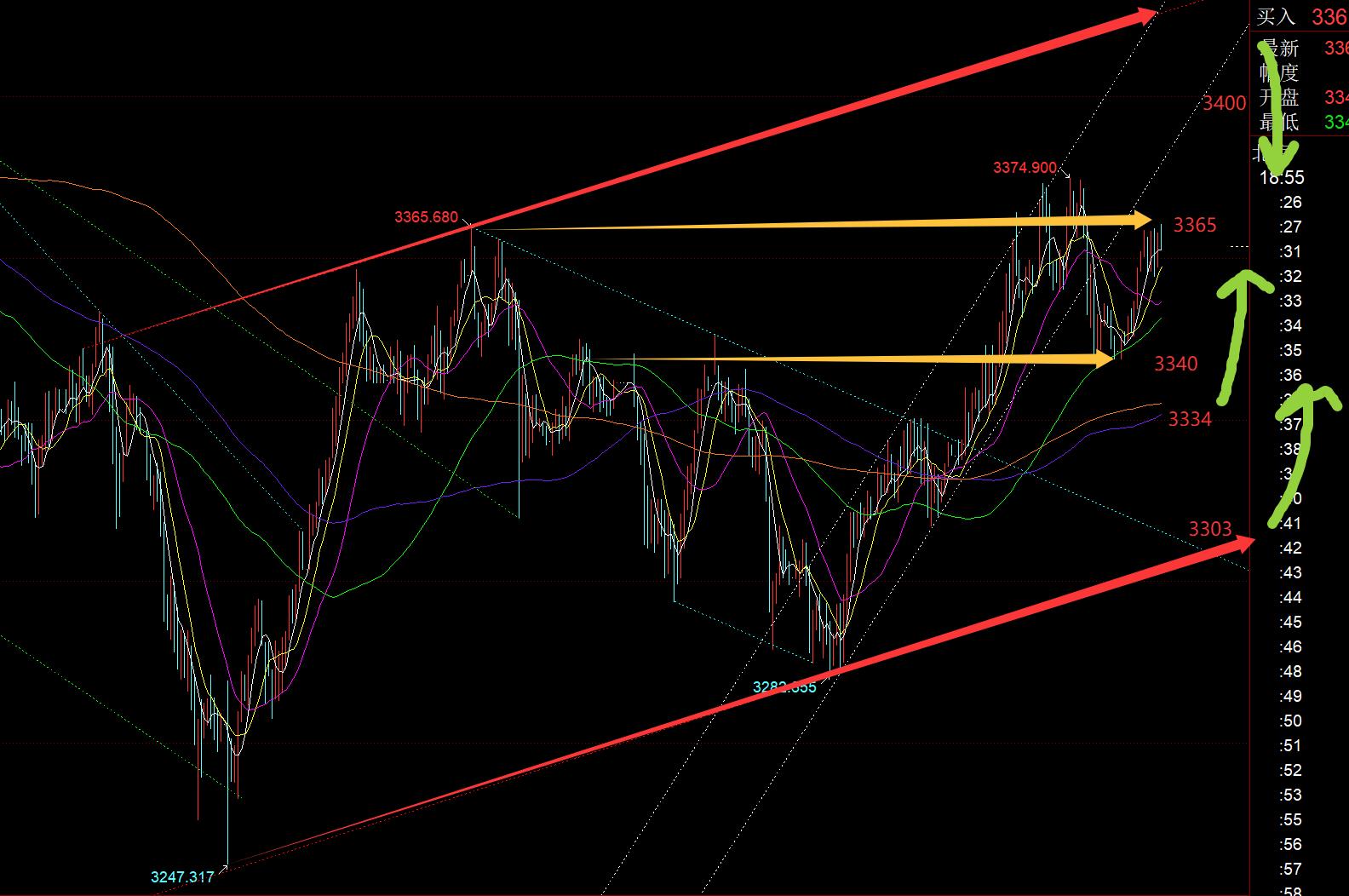

CPI is coming, Gold 3340-3375 focuses on breakthrough direction

Wonderful introduction:

Life needs a smile. When you meet friends and relatives, you can give them a smile, which can inspire people's hearts and enhance friendships. When you receive help from strangers, you will feel www.xmhouses.comfortable with both parties; if you give yourself a smile, life will be better!

Hello everyone, today XM Foreign Exchange will bring you "[XM Official Website]: CPI is www.xmhouses.coming, Gold 3340-3375 focuses on breakthrough directions". Hope it will be helpful to you! The original content is as follows:

Zheng's silver point: CPI is www.xmhouses.coming, gold 3340-3375 focuses on the breakthrough direction

Review yesterday's market trend and technical points:

First, gold: Yesterday's opening gap and pull up touched the short-term channel upper track and the 618 split resistance level 3374 line. After under pressure, fill the gap and keep choosing when the hourly line is stable. Bullish; European market has been hit by 3374 many times without success, and the US market fell below the mid-line track of the hourly line, which means that we cannot rush to repeatedly bullish above the intraday low; eventually we will lose the lower track of the short-term channel, so we will make a certain retracement correction downward, but following the trend of last Thursday and Friday, there is not much room for downward correction, and it just happens to stabilize above the mid-line track of the daily line 3340, so we will use this as defense and continue to try to bullish at night. Today, we will usher in a wave of re-moval as expected. High;

Second, silver: Yesterday, the Asian and European sessions continued to force a strong short squeeze and pull up, piercing the upper resistance level of the weekly channel at 39, and the upper resistance level of the daily channel at 38.8, the US session also ushered in a wave of profit-taking retracement correction; Similarly, when the hourly line falls below the middle track, you cannot rush to look bullish, and wait for the bottom fluctuation to stop falling before you can make a layout;

Third, crude oil: mentioned yesterday Pay attention to the running of the channel in the past few days. After testing the upper rail 69.5 line under pressure, it finally suppressed the downward trend. The lower rail 66.8 was tested, and the short-term direction was changed rapidly within one day. Yesterday I looked at the right direction, but missed the opportunity, because I originally waited for the upper rail to stagnate after 22 o'clock before trying, but it started early at 21 o'clock;

Today's market analysis and interpretation:

First, the golden daily lineLevel: After three consecutive positives, the closing of negative is a correction. According to the recent oscillation cycle, it is expected to close positive today, and the focus is on whether the future market can continue to continue positive; today we must first pay attention to whether the middle track 3340 line can stabilize and continue to rise, because yesterday's negative line was confirmed to retrace; if the fluctuation can continue, then there is hope for testing 3400 and up; on the contrary, today's surge and fall back to 3340 or below, then we must continue to hover below the 3375 resistance level and converge the lower triangle line support above 3300; then the cpi inflation data released tonight will be Relatively important, the market expects to increase to 2.7% this time. Once the announced value is greater than or equal to 2.7%, inflation will weaken interest rate cuts and suppress gold prices; on the contrary, the announced value is less than 2.7%, which does not meet the expected market and will boost gold prices; if it is less than or equal to 2.4%, it will increase the probability of interest rate cuts and significantly boost gold prices;

Second, gold 4-hour level: Tonight, the lower middle track is the upper support of 3340 and the upper resistance is 3375, which side will effectively break through;

Third, the golden hourly line level: after stabilizing 3340 today, breaking the morning resistance level 3351-52 upward and hitting the 3365-66 line, then insisting on low bullish overnight will be successful; currently running narrowly at 3365-3356, that is, waiting for the data tonight; from the technical perspective, focus on paying attention to the support of the middle track 3352 line below, and keeping on the 3374-75 resistance above, and the big positive or continuous positive breakthrough can open up a new pull-up space; if the data is negative, the middle track downward does not stick to the middle track , do not rush to bullish, wait for the decline momentum to slow down, and there will be a signal to stop falling, and then choose to layout a low-end layout. Below 3340, there is still 3334 line 618 support level, which is also an annual moving average. If you fall again, you will give a good bottom-end low. Just take action below 3310. The future market stability will still repeatedly rise to the 3365 and 3374 resistance levels; (As long as you converge along the daily line, the low point will gradually move upwards. Every time you get close to the low, it is a good bottom-end point, and basically a 50-100-meter pull-up)

In terms of silver: the recent trend of silver is basically a wave of pull-up + a few weeks of oscillation and correction + a wave of pull-up; therefore, yesterday, the top long upper shadow inverted hammer head appeared in the negative K, and 39.1 temporarily showed a certain suppression, and a certain range of consolidation and correction may be carried out in the subsequent consolidation and correction, and the consolidation pattern is generally an oscillation and downward channel or parallel channel or convergence triangle; for today, the sharp drop in the morning does not continue, and the mid-track of the test hour line will not move sideways, and the macd is close to the zero axis, which is also waiting for the data to stimulate and guide tonight; if you go down firstExploring 37.6, 37.3, etc. have segmented support and daily short-term moving average support. K can fluctuate and bullish; if it pulls up first, 38.8-39 is close to the upper track of the daily and weekly channels again, it will fluctuate and fall back;

Crude oil: At present, the lower rail of the channel has been lost, and the reverse pressure point is moved up by 67 lines. As long as the pressure is under this position, it is temporarily unable to rebound; but at the same time, the short-term macd has entered a certain bottom divergence one after another, especially the price breaks a new low, or it may easily bottom and rise; there is no large investment value for the time being, observe and wait first; if you return to the channel, you can continue to sell high and buy low according to the upper and lower rails of the channel; if you continue to fall, it is not suitable to chase down, wait for the long-term lower shadow K to see the oversold rebound;

The above are several views of the author's technical analysis, as a reference, and it is also a summary of the technical experience accumulated by watching and reviewing the market for more than 12 hours a day in the past twelve years. Tianhu will disclose technical points, and cooperate with text and video interpretation. Friends who want to learn can www.xmhouses.compare and reference based on actual trends; those who recognize ideas can refer to operations, lead defense well, risk control first; those who do not agree should just be floating by; thank everyone for their support and attention;

[The article views are for reference only. Investment is risky. You should be cautious in entering the market, operate rationally, strictly set losses, control positions, risk control first, and bear the profit and loss at your own risk]

Contributor: Zheng's Dianyin

A study on the market for more than 12 hours a day, persist for ten years, and detailed technical interpretations are made public on the entire network, serving the whole network with sincerity, sincerity, perseverance and wholeheartedness! www.xmhouses.comments written on major financial websites! Proficient in the K-line rules, channel rules, time rules, moving average rules, segmentation rules, and top and bottom rules; student cooperation registration hotline - WeChat: zdf289984986

The above content is all about "[XM official website]: CPI is www.xmhouses.coming, Gold 3340-3375 focuses on the breakthrough direction", which was carefully www.xmhouses.compiled and edited by the XM Foreign Exchange editor. I hope it will be helpful to your trading! Thanks for the support!

Due to the author's limited ability and time constraints, some content in the article still needs to be discussed and studied in depth. Therefore, in the future, the author will conduct extended research and discussion on the following issues:

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here