Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- The battle between eagles and pigeons has not yet ended. Is it a blessing or a d

- 8.25 Gold bottomed out and rebounded, breaking the balance, and continue to buy

- New Zealand dollar/USD rose about 1.4% in two days

- Avoid industry minefields

- Demand for Germany's 10-year government bonds cools down, analysis of short-term

market news

High-level hammer heads are extended, gold and silver need to be much lower

Wonderful Introduction:

Green life is full of hope, beautiful fantasy, hope for the future, and the ideal of longing is the green of life. The road we are going tomorrow is green, just like the grass on the wilderness, releasing the vitality of life.

Hello everyone, today XM Foreign Exchange will bring you "[XM Foreign Exchange Platform]: High-level hammer heads are extended, and gold and silver still need to be low." Hope it will be helpful to you! The original content is as follows:

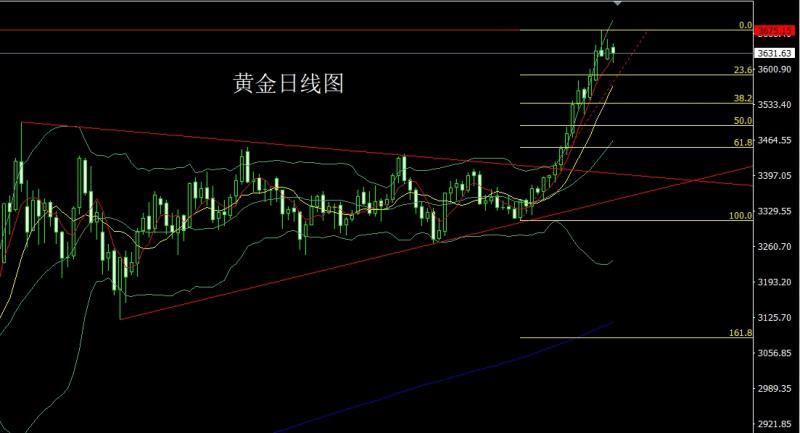

Yesterday, the gold market was consolidated. The market opened at 3642.5 in the morning and then the market first rose and gave the position of 3649.1. The market fluctuated and fell. The daily line was at the lowest point of 3612.9 and then the market rose strongly. The US market was given to the position of 3644. The market was consolidated. The daily line finally closed at 3631.6. Then the market closed in a hammer head with a longer lower shadow line. This pattern After the end, today's market still needs to be low. At the point, the long 3325 and 3322 below are as high as long 3368-3370 last week and the long 3377 and 3385 long 3385 long 3450 after reducing positions. Last Friday, the stop loss followed by 3570 after reducing positions. Today, the 3618 long 3612 stop loss is, and the target is 3641 and 3652 and 3665 and 3672.

The silver market opened at 41.135 yesterday and the market fell first. The daily line was at the lowest point of 40.882 and then the market rose strongly. The daily line reached the highest point of 41.755 and then the market consolidated. The daily line finally closed at 41.548. The daily line closed with a medium-positive line with an upper and lower shadow line. After this pattern ended, today's market fell back to long. At the point, the long position of 37.8 below and the long position of 38.8 last Friday, and the stop loss followed at 39.5. Yesterday, the long position of 40.95 was reduced at 40.95. Today,41.2 long stop loss 41, target 41.75, breaking the position 42.2 and 42.5-42.7.

European and American markets opened at 1.16947 yesterday and the market first rose. The market fell strongly. The daily line was at the lowest point of 1.16582. The market rose strongly. The daily line reached the highest point of 1.17457. After the market was consolidated. The daily line finally closed at 1.17354. The market closed with a medium-positive line with a long lower shadow line. After this pattern ended, it still fell back today. At the point, the long position of 1.16600 yesterday, and the stop loss followed by 1.16700. Today, the stop loss was 1.16900. The target was 1.17350 and 1.17550 and 1.17850.

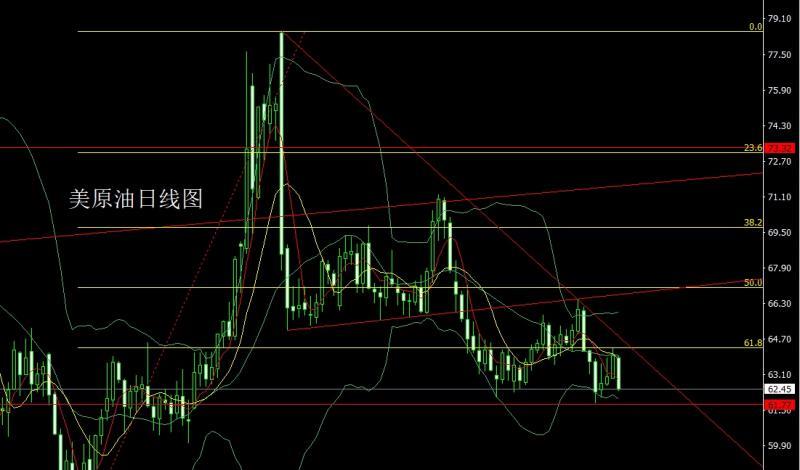

The US crude oil market opened at 63.85 yesterday and the market rose slightly. The market fluctuated strongly. The daily line was at the lowest point of 62.38 and then the market consolidated. The daily line finally closed at 62.45 and then the market closed with a saturated large negative line with a slightly shadow line. After this pattern ended, the daily line was negative and covered with positive lines. Today, the target below 63.2 short stop loss 63.7 is 62.38, and the target below 62 and 61.5 and 61.2.

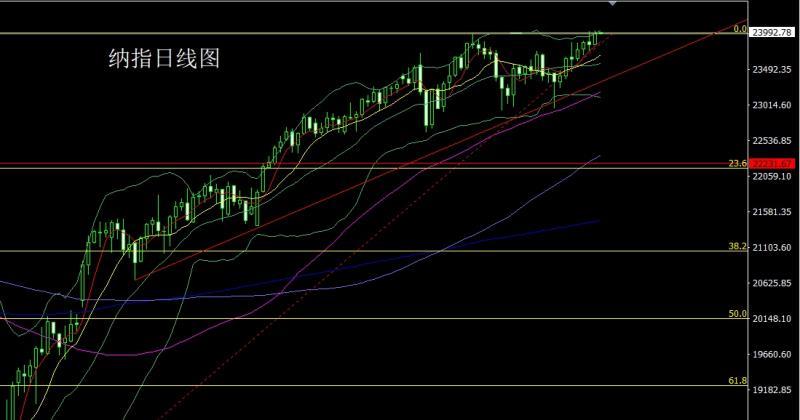

Nasdaq market opened at 23830.13 yesterday and the market slightly fell back to 23824.85. After the market fluctuated strongly. The market consolidated. The daily line finally closed at 23977.75. Then the market closed with a medium-positive line with a slightly longer upper shadow line. After this pattern ended, the target of 23900 more than 23850 is 24050 and 24120 and 24200.

Basics, yesterday's fundamentals. Three sources said that the ECB decision makers believe that the December meeting is the most realistic time frame for discussing whether another interest rate cut is needed to buffer the impact of US tariffs on the euro zone economy. The ECB held interest rates unchanged on Thursday and maintained optimism about economic growth and inflation, curbing expectations for further rate cuts. But ECB governing www.xmhouses.committee sources said the debate on the rate cut is not over yet, but policymakers may not be able to obtain enough information to make appropriate assessments before their next meeting on October 29. This means that the December 18 meeting is seen as more likely to discuss lower borrowing, given the upcoming inflation and economic growth data and the next batch of forecasts.The date of the loan cost. The US then recorded an annual rate of unseasonally adjusted CPI in August at 2.9%, the highest since January. The US seasonally adjusted CPI monthly rate in August was 0.4%, the highest since January. The number of initial unemployment claims in the United States recorded 263,000 in the week ending September 6, surged to a high in the past four years. Traders fully price the Fed will cut interest rates three times by the end of 2025. Therefore, the gold market rose strongly after the data. After OPEC+ increased production in crude oil, the IEA raised its global oil supply and demand forecast this year. Affected by the increase in production of OPEC+ countries, global oil supply reached a record level of 106.9 million barrels per day in August. Therefore, the crude oil market plummeted, and today's fundamentals mainly look at the initial value of the expected one-year inflation rate in the United States at 22:00 and the initial value of the University of Michigan Consumer Confidence Index in the United States in September.

In terms of operation, gold: 3325 and 3322 of the bottom and 3322 long and 3377 and 3385 long and 3385 long and 3450 long and 3563 long and 3570 last week, the stop loss followed at 3570 last Friday, and the stop loss followed at 3618 long and 3612 today, and the target is 3641 and 3652 and 3665 and 3672.

Silver: 37.8 long and 37.8 long and 38.8 long last Friday The stop loss follow-up was held at 39.5, yesterday's 40.95 position reduction was followed by the stop loss follow-up at 40.95, today's 41.2 position reduction was 41.75, and the breaking point was 42.2 and 42.5-42.7.

Europe and the United States: yesterday's 1.16600 position reduction follow-up at 1.16700, today's 1.17100 position reduction was 1.16900, today's 1.17350 and 1.17550 and 1.17850.

U.S. crude oil: Today's short stop loss 63.7, the lower target is 62.38, and the lower target is 62 and 61.5 and 61.2.

Nasdaq: Today's 23,900 stop loss 23,850 target is 24,050 and 24,120 and 24,200.

The above content is all about "[XM Foreign Exchange Platform]: High hammer heads are extended, gold and silver still need to be low". It is carefully www.xmhouses.compiled and edited by the editor of XM Foreign Exchange. I hope it will be helpful to your trading! Thanks for the support!

Only the strong know how to fight; the weak are not qualified to fail, but are born to be conquered. Step up to learn the next article!

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here