Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- The pound 1.34 defense line sounds the "air raid alarm", and the "hawkish rebell

- Gold fluctuates again!

- As the growth spread widens, can the US dollar/Canada dollar hit 1.3778 again?

- US dollar index lowers under pressure, Milan "probably" taking office before the

- Non-agricultural aftershocks! The 10-year U.S. Treasury yield is on the verge of

market analysis

The golden range will only exert its strength after breaking through, and Europe and the United States will gain short-term support.

Wonderful introduction:

One person’s happiness may be fake, but the happiness of a group of people can no longer distinguish between true and false. They squandered their youth to their heart's content, wishing they could burn it all away. Their posture was like a carnival before the end of the world.

Hello everyone, today XM Forex will bring you "[XM Foreign Exchange Decision Analysis]: The gold range will not be strong until it breaks, and Europe and the United States will gain short-term support." Hope this helps you! The original content is as follows:

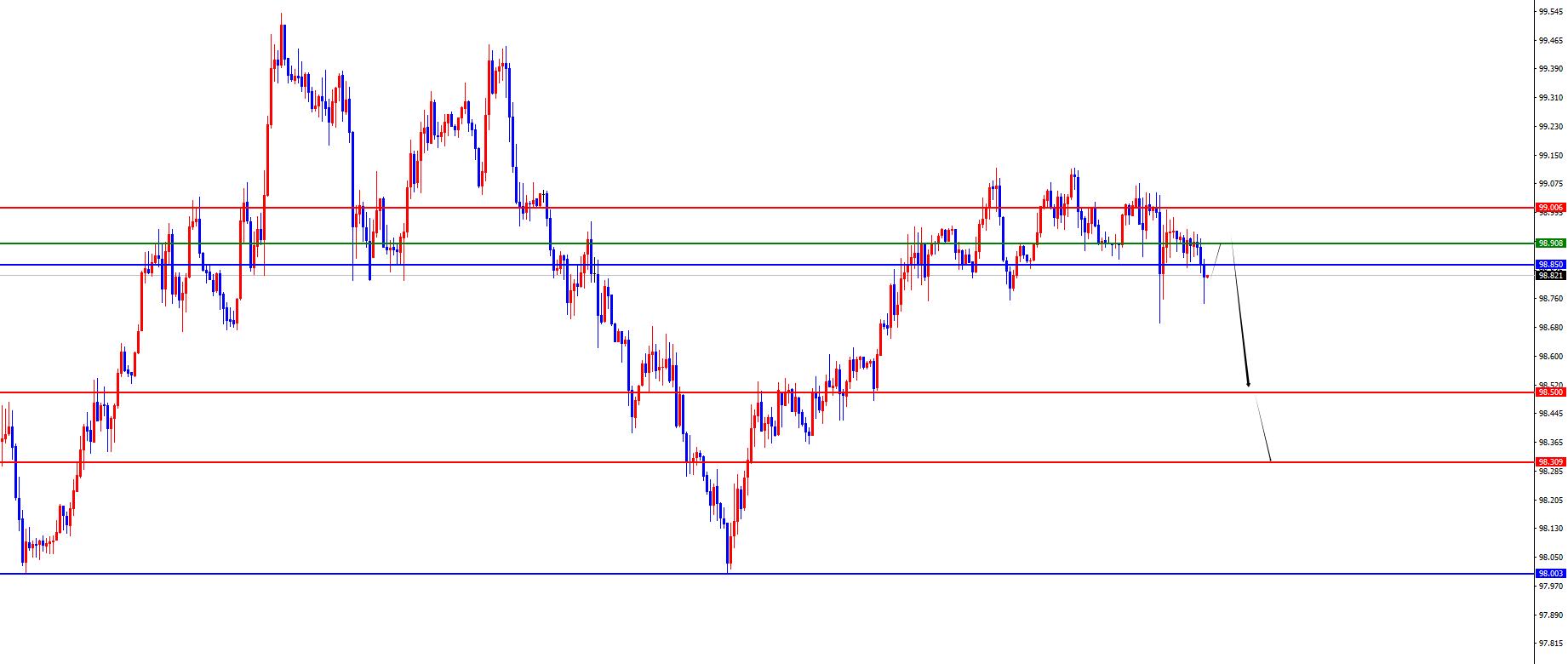

U.S. Dollar Index

In terms of the performance of the U.S. Dollar Index, the U.S. Dollar Index showed a volatile trend last Friday. The U.S. dollar index price climbed to a maximum of 99.075 that day, dropped to a minimum of 98.692, and finally closed at 98.917. Looking back at the overall market performance last Friday, the price first gained support and rose in the short term, then fell under pressure from the previous day's high, and finally ended with a cross on the day.

From a multi-cycle analysis, the weekly price has continued to fluctuate in the early stage but is generally supported by the key position of the weekly. The current weekly support is in the 98 area, and subsequent attention will be paid to further mid-term bulls (need to pay attention to the gap position). From the daily level, as time goes by, the current daily resistance is in the 98.85 area. This position is the key to the trend of the band. The short-term price will pierce it. The key is to follow up on whether the market can actually close below this position. Once it breaks down, focus on the pressure on the subsequent band. At the four-hour level, the price last Friday consolidated up and down at the four-hour key position, and at the same time pierced the daily support. The price is currently showing further downward trends, so focus on the resistance in the 98.90-99 range above and the 98.50-98.30 area below in the short term.

The U.S. index is short in the range of 98.90-99, defending 5 US dollars, and targeting 98.50-98.30

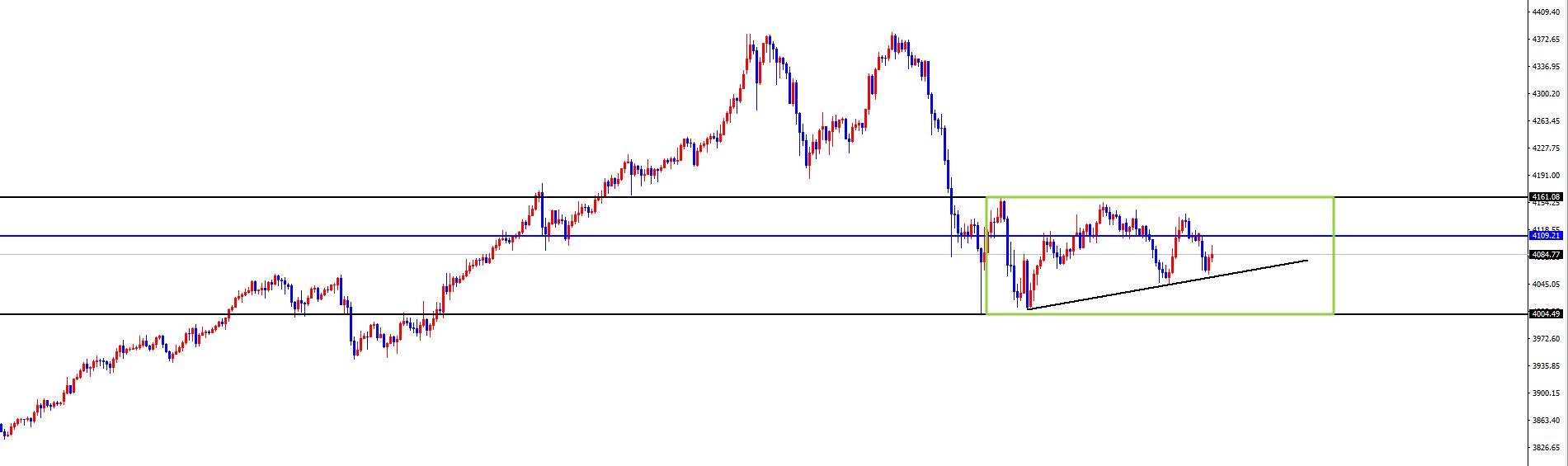

Gold

In terms of gold, the price of gold generally showed a decline last Friday. The highest price on the day rose to 4144, the lowest fell to 4044.01, and closed at 4112.79 positions. During the early trading last Friday, the price first came under pressure at the daily resistance position, and then broke through the four-hour support. After being supported before the U.S. market, the price rose again. In the end, it still ended with a negative line, but the lower lead closed below.

From a multi-cycle analysis, first observe the monthly rhythm. From a long-term perspective, the 3150 position is the watershed of the long-term trend. The price can be treated as long as it is above this position. From the perspective of the weekly level, the current watershed between long and short weekly lines is at 3707. The price can be treated as long as the midline is above this position. From the daily level, we need to pay attention to the 4141 area resistance for the time being. In the early rise, the low position after the price broke through the daily support became the key. Therefore, the current 4004 position is the key to whether the band can continue to fall. At the four-hour level, the price consolidated up and down at the four-hour key position last Thursday and Friday. The price currently tends to fluctuate in the 4004-4161 range, and we will pay attention to the continuation after breaking the range. In the short term, we will first focus on the resistance near the gap, the daily line and the shock high point of 4161. Therefore, we will treat it as a shock before breaking the range, and then pay attention to the continuation performance after breaking the range.

Gold is paying attention to the 4004-4161 range shock, and will follow the layout after the range breaks out

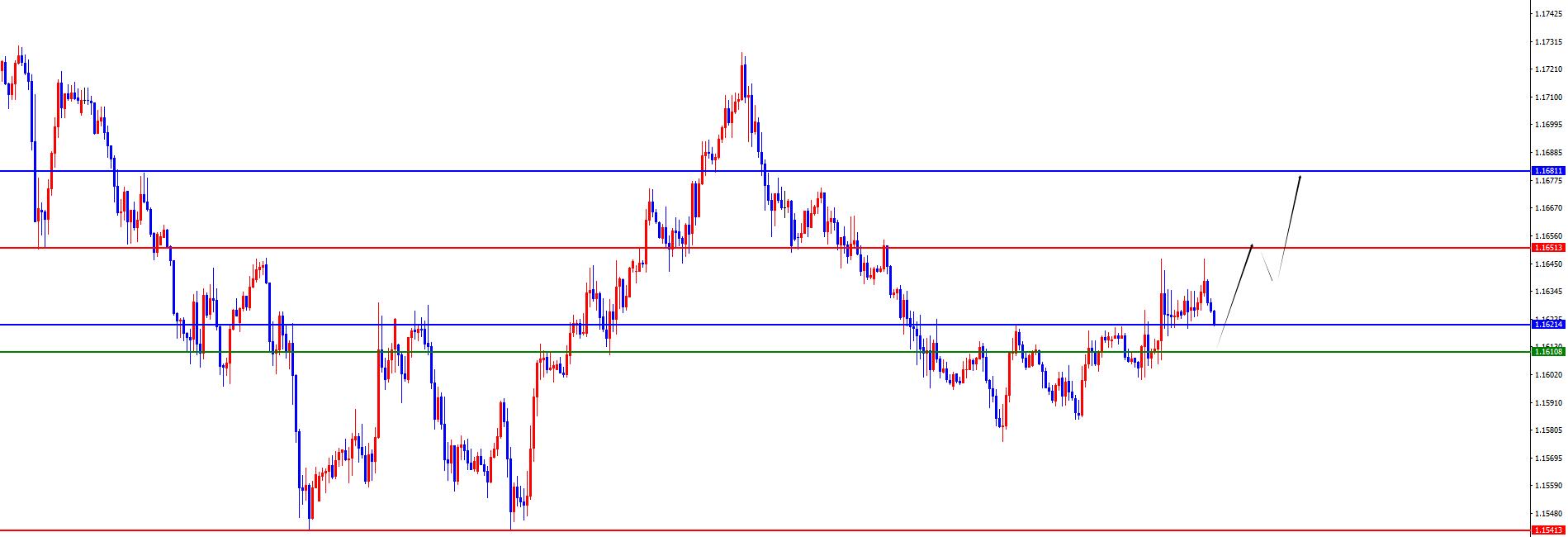

Europe and the United States

In Europe and the United States, European and American prices generally showed an increase last Friday. The price fell to a minimum of 1.1600 on that day, rose to a maximum of 1.1647, and closed at 1.1627. Looking back at the performance of the European and American markets last Friday, during the early trading period, the short-term price first ran within the daily resistance and four-hour support range. After the US market, the price broke through the daily resistance, and finally ended the day with a strong sun.

From a multi-cycle analysis, from the monthly level, Europe and the United States are supported at the 1.1100 position, so the price is treated as a long-term position above this position. From the weekly level, the weekly resistance is in the 1.1680 area. This position is the long-short watershed of the mid-line trend. The price below this position is treated as bearish in the mid-line. From the daily level, the daily line is the key for us to emphasize the band trend. The price broke through the resistance position of 1.1620 last Friday, and we will pay attention to the continued rise of the price. From the four-hour level, the price broke through the four-hour resistance position last Thursday night, and then continued to rise on Friday relying on the four-hour support. The current four-hour support is in the 1.1610 area, and the price will be bullish in the short term above this position. The price is fluctuating and rising in the short term on the hour, so temporarily focus on the four-hour support and daily support areas to see the upward trend, and the short-term focus on the 1.1650-1.1680 area above.

Europe and America have a lot of range 1.1610-20, defense 40 points, target 1.1650-1.1680

[Today’s key financial data and events] Monday, October 27, 2025

① To be determined, domestic refined oil products will open a new round of price adjustment window

② To be determined, the 2025 Financial Street Forum Year Will be held

③ To be determined: US President Trump’s visit to Japan

④16:15 RBA Chairman Bullock participates in fireside chat

⑤17:00 German October IFO Business Climate Index

⑥19:00 CBI Retail Sales Difference in the UK in October

⑦20:30 Monthly Durable Goods Orders in the US in September

⑧22:30 Dallas Fed Business Activity Index in the US in October

Note: The above is only a personal opinion strategy, for reference and www.xmhouses.communication only. It does not give customers any investment advice, has nothing to do with their investment, and is not a basis for placing orders.

The above content is all about "[XM Foreign Exchange Decision Analysis]: The golden range will be strong only after it breaks, and Europe and the United States will gain support in the short term". It is carefully www.xmhouses.compiled and edited by the editor of XM Foreign Exchange. I hope it will be helpful to your trading! Thanks for the support!

Every successful person has a beginning. Only by having the courage to start can you find the way to success. Read the next article now!

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here