Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- Gold needs to pay attention to risks in the short term, and Europe and the Unite

- Guide to short-term operation of major currencies

- The US dollar/CHF has been fluctuating recently. When will it break through 0.81

- [Hot Spot Focus] Break 3500 again, and the gold price hit a record high! Silver

- The market no longer steps on the brakes and dances delicately with Trump's poli

market news

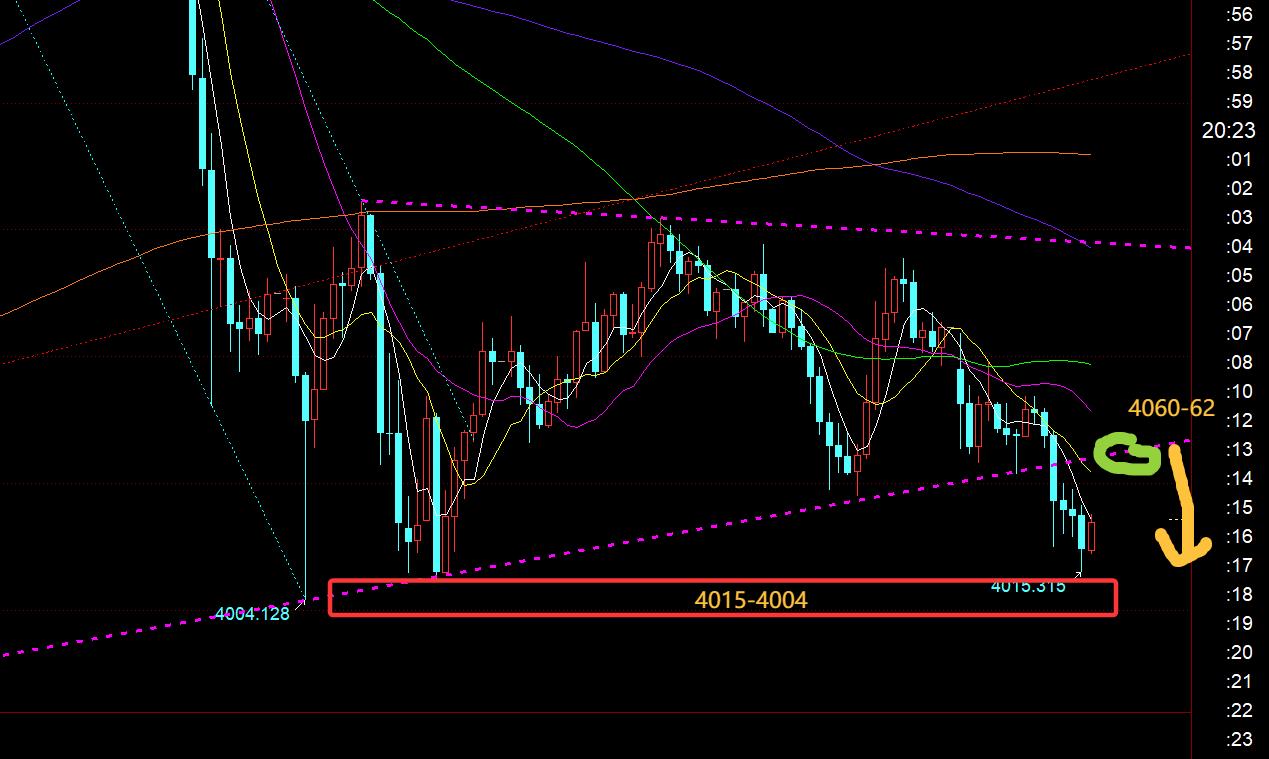

The gold European market breaks through the bottom triangle consolidation range, pay attention to the gains and losses of 4060 tonight

Wonderful introduction:

Optimism is the line of egrets that go straight up to the sky, optimism is the thousands of white sails on the side of the sunken boat, optimism is the luxuriant grass blowing in the wind at the head of Parrot Island, optimism is the little bits of falling red that turn into spring mud to protect the flowers.

Hello everyone, today XM Forex will bring you "[XM Group]: Gold European market broke through the bottom triangle consolidation range, pay attention to the gains and losses of 4060 tonight." Hope this helps you! The original content is as follows:

Zheng's Point Silver: Gold European market breaks through the bottom triangle consolidation range, pay attention to the gains and losses of 4060 tonight

Review last Friday's market trends and technical points:

First, gold: last Friday morning, it stepped back on 4107, a small double bottom support rebounded, and broke through the resistance of the hourly 66-day moving average, then stepped back to follow and saw a rebound to 4107 As a Feng Shui Ridge defense, the result did not continue after 10 points, and fell again for 66 days, and broke through the low of 4107; the European market fell continuously, and the bottom converged before the US market, and the triangle lower track supported the 4045 line. The plan is to go up at 4080, but it does not go down, so the 4090 line prompts to try to speculate at the bottom. When it breaks above the hourly mid-range 4100, it goes back to 4120 to prompt bullishness again. Finally, the 4135 line prompts profit reduction and closes the rice. The bottom position in the second half of the night was protected by falling back, which can also be considered to make up for some losses during the day;

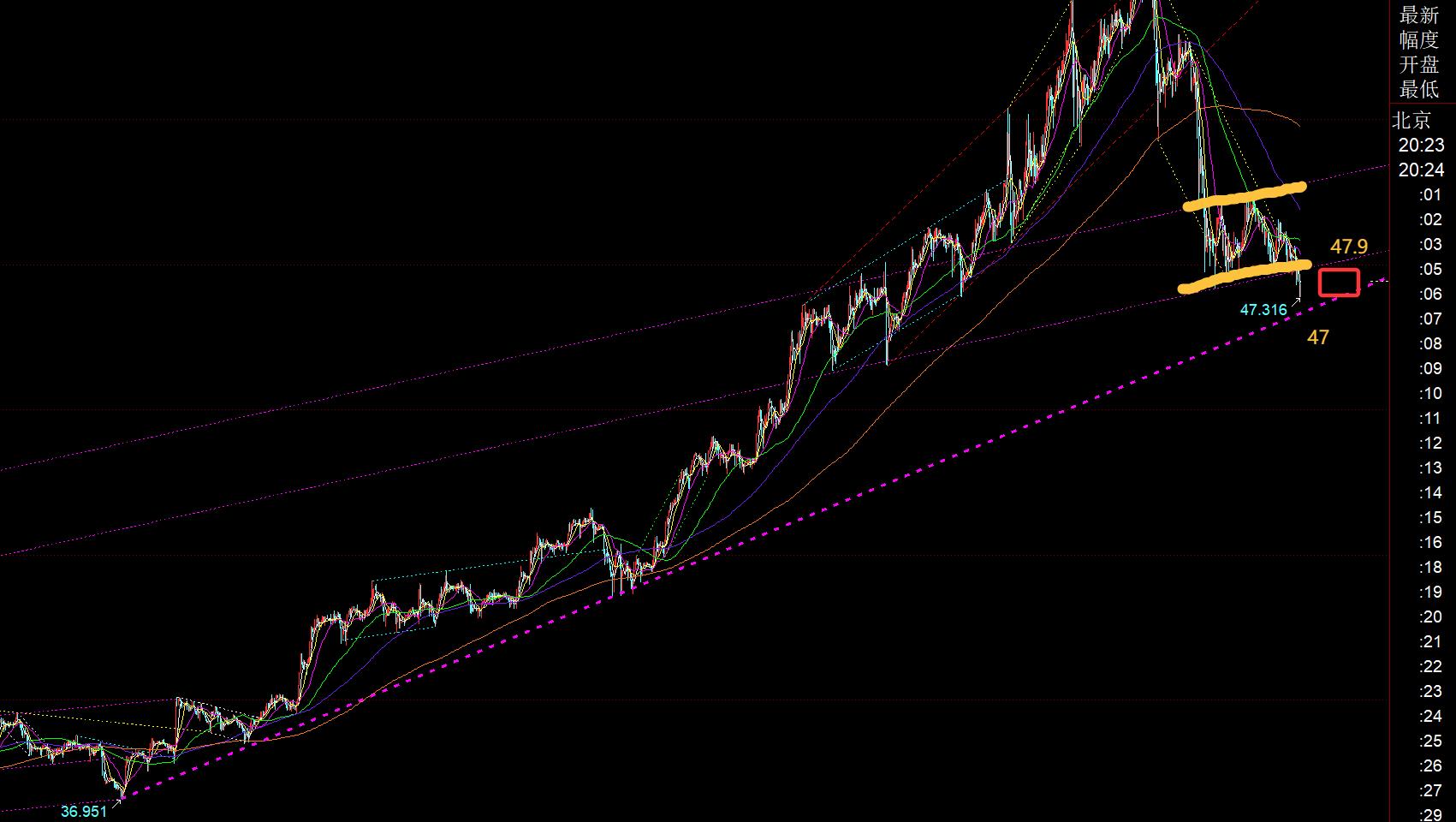

Second, in terms of silver: I tried a small trend line support during the day last Friday, but the European market also fell below 1 Wave, the US market pointed out that the upper support of 47.75 is in line, but did not follow gold;

Today's market analysis and interpretation:

First, the gold weekly level: it closed negative for the first time last week after nine consecutive positives, so the focus is on closing this week. Since this year, it has been either a big negative or double negative at most, and it will immediately stabilize and strengthen again; there is no need to worry about the trend, the bulls have no impact, the callback is to make room for future gains., every deep decline is an opportunity to reach a relatively low level in the later period;

Second, the daily level of gold: from last Wednesday to Friday, there was counter pressure around the lower track of the previous channel or the short-term moving average was under pressure, supporting the middle track, hovering between the two, repeatedly oscillating, repeatedly bottoming out and rising; and today it is under pressure On the 5th, at this time, the downward trend began to fall below the middle track. This move may produce a diving action, breaking down the middle track and closing in the negative direction. Then on the second day, or at the latest the third day, it will close positive and return to the middle track for short-term stabilization. This move has appeared in February, April, and May this year, and every time Only when the mid-rail is pierced can it be effectively stabilized. At that time, it was also called: "If it is not broken, it will not be established. If it is broken, it will be established." Therefore, in the following days, what we need to pay attention to is the continuity after breaking the mid-rail. If there is another bottom-out pull-up K or a direct bottom of Dayang K, the short-term bottom will be out, and it will be announced again this week. Cut interest rates, and we are still optimistic about a second high;

Third, the golden 4-hour level: continue to pay attention to the gains and losses of the mid-rail pressure, which moves down to 4095 at this time. Only when it breaks above it at a certain moment can this cycle become stronger, and pay attention to support above 4004;

Fourth, the golden hourly level: From the picture above, the bottom convergence triangle has broken down continuously during the European market today. Then there will be a rebound before and after the US market, which is easy to attract bulls. There is a second downward trend. Pay attention to the channel counter-pressure point 4060, which is under pressure in the short term. Bearish, the lower support is 4015 and 4004. If the 4000 mark is lost, pay attention to 3975, 3945, and the limit is 3914. Personally, I think the lower space is not big, or the time is not long-lasting. It will be at the bottom in 2 hours and 4 hours. From the state, it is easy to surprise the oversold rebound by pulling down; therefore, try not to chase the decline before the rebound is in place; in addition, if the price breaks through 4060 and goes up again and returns to the convergence triangle, it will either expand the convergence range and continue to consolidate, or slowly stabilize and move upward. You cannot be blindly bearish; therefore, if you are going to be bearish for the second time tonight, the closing price must not fall back into the purple triangle in the chart. If you want to be bullish at a low level, you need to wait until the second decline is www.xmhouses.completed or there are stable signals near the mentioned supports before considering;

Silver: Judging from the picture, the European market also broke through the bottom consolidation range. The 47.9 line is called the counter-pressure point. If it wants to fall for the second time, it must not break through and then stand on it. The lower support is the purple trend line that is unilaterally supported by 36.95. The corresponding support point is the 47 line, which stabilizes when it is touched. Then try a bullish rebound; so pay attention to the operation within the range of 47.9-47, and pay attention to gains and losses;

In terms of crude oil: briefly speaking, 60 support, 58.8 support, and resistance below 64.3 should be treated within the range;

The above are several views of the author's technical analysis, as a reference, it is also a summary of the technical experience accumulated from watching and reviewing the market for more than 12 hours a day for 12 years. The technical points will be disclosed every day, and www.xmhouses.combined with text and video interpretation, friends who want to learn can www.xmhouses.compare and reference based on the actual trend; those who agree with the idea can refer to the operation, take good defense, and risk control first; those who do not agree can just ignore it; thank you for your support and attention;

[The opinions of the article are for reference only. Investments are risky. You need to be cautious when entering the market, operate rationally, set losses strictly, control positions, risk control first, and be responsible for profits and losses]

Writer: Zheng's Dianyin

Read the market for more than 12 hours a day and study for ten years. Detailed technical interpretations are made public on the entire network. We will serve with sincerity, dedication, sincerity, perseverance, and wholeheartedness to the end! Write www.xmhouses.comments on major financial websites! Proficient in K-line rules, channel rules, time rules, moving average rules, segmentation rules, top-bottom rules; student cooperation registration hotline - WeChat: zdf289984986

The above content is about "[XM Group]: The gold European market breaks the bottom triangle consolidation range, pay attention to the gains and losses of 4060 tonight". It is carefully www.xmhouses.compiled and edited by the XM foreign exchange editor. I hope it will be helpful to your trading! Thanks for the support!

Only the strong know how to fight; the weak are not even qualified to fail, but are born to be conquered. Hurry up and study the next content!

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here